Cash Balance Plans Face Stormy Weather

What do cash balance pension plans and water tides have in common? The natural reaction would likely be “not much.” However, cash balance plans have been operating in a relatively benign, low-tide environment, but now face a high-tide sea change where we believe greater care and attention is required. This is especially true for cash balance plans that incorporate a floor within their interest crediting rate formula. In other words, plan sponsors may need to start preparing now as they "wave" goodbye to low cash balance interest credits.

The ebb and flow of cash balance plans

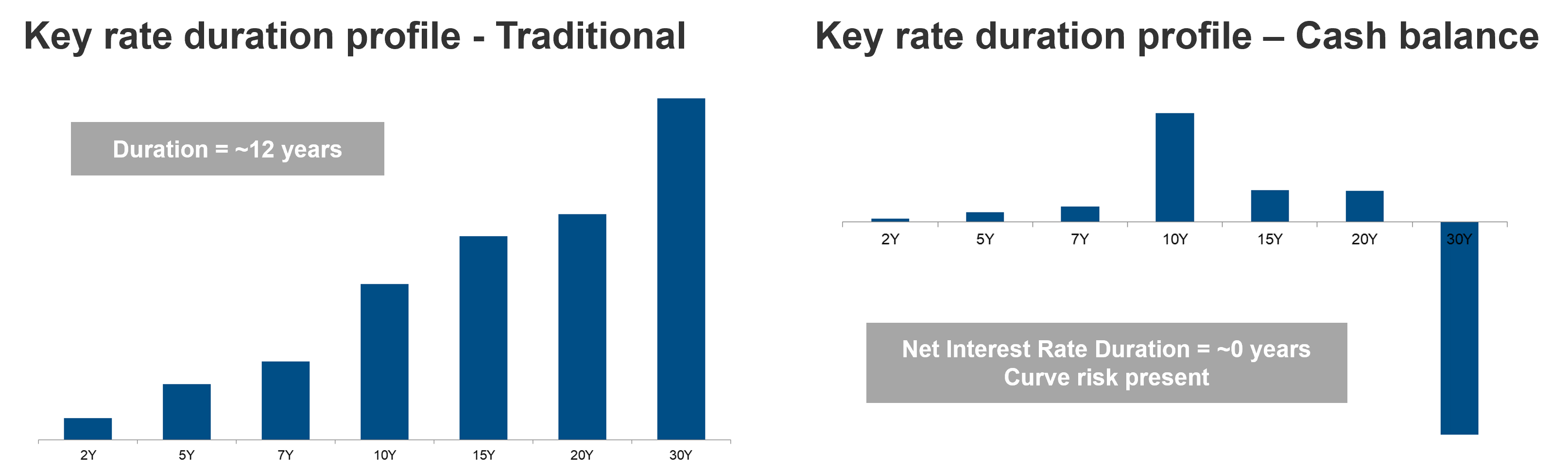

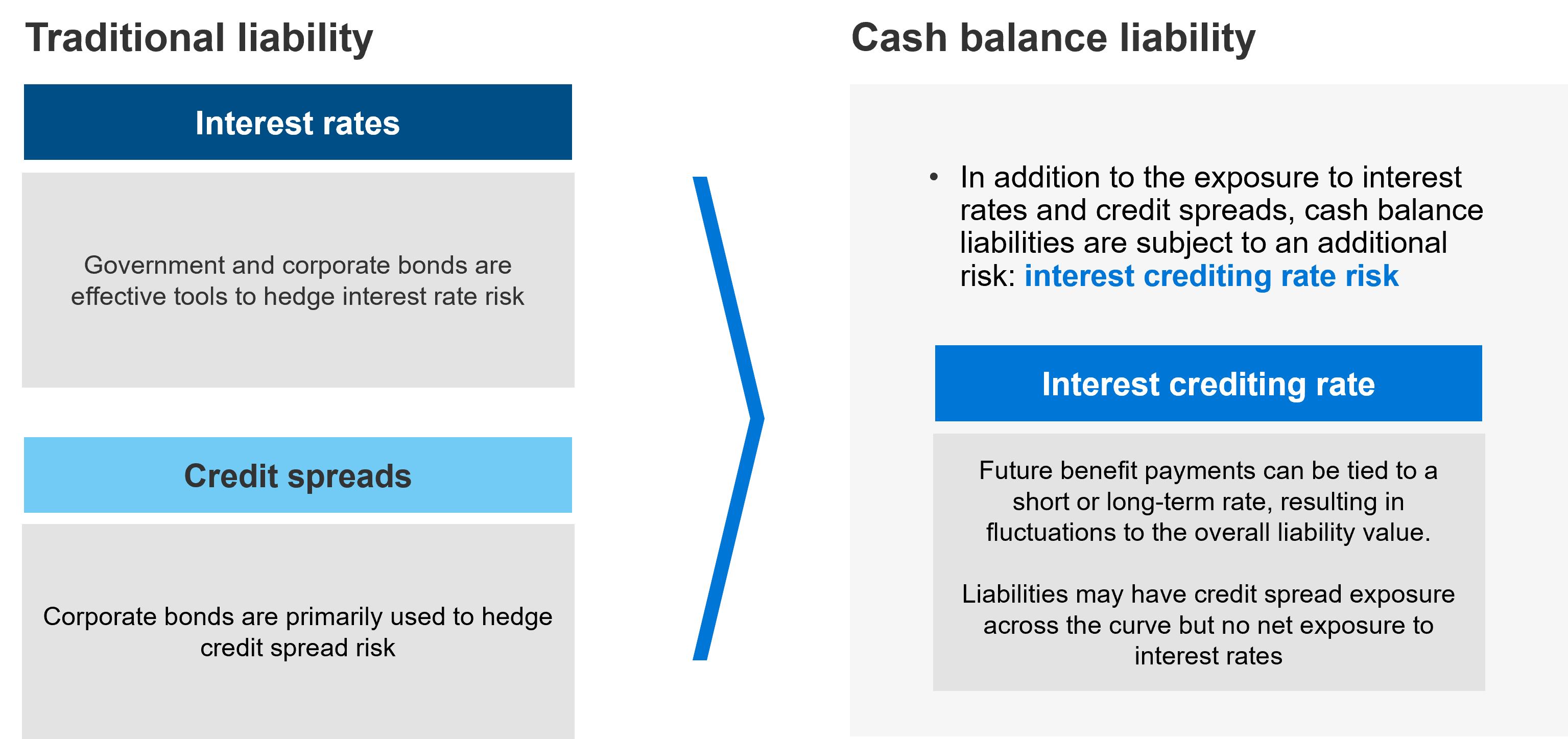

Cash balance plans have become increasingly popular and have grown significantly within the retirement plan universe. For many defined benefit plan sponsors, the cash balance component within their liability has grown and may represent a significant share of total plan liabilities today. In addition to the traditional discount rate risk that many LDI strategies are designed to hedge, cash balance plans may introduce crediting rate risk as future benefit payments can fluctuate with changes in an interest crediting rate (Figure 1).

A common approach to determining the interest crediting rate is to peg it to a Treasury yield, such as the 30-year or 10-year Treasury.1 To add to the LDI considerations, plans may combine an interest crediting rate linked to a Treasury yield with a minimum level (floor) on the rate of balance increases in any year. This interest crediting rate floor feature introduces another important factor to consider in developing the hedging solution (beyond interest rate and credit spread risks).

Figure 1: Liability risks

Source: LGIMA. For illustrative purposes only.

Operating in a low-tide environment

When water levels are normal, vacationers can enjoy pristine beaches, calm weather and the activities that accompany them. Much the same, cash balance plans with a floor have been able to broadly ignore their crediting rate risk given the low interest rate environment over the past several years. Let's look at an example of a plan with an interest crediting rate that is the higher of 4% (the floor) or the yield on the 30-year Treasury. As long as 30-year yields are beneath the floor, the crediting rate remains fixed at 4%. This essentially fixes the projected account balance (since it is not sensitive to interest rate changes), resulting in a liability exposure similar to a traditional pension plan (Figure 2).

In the recent past, yields have been so low that many plan sponsors have largely ignored this dynamic and implemented traditional fixed income strategies to address the plan’s discount rate risk. Given market developments ranging from historically high inflation, a hawkish Federal Reserve and supply/demand imbalances, the tides are changing, forcing cash balance plans to re-evaluate the risks inherent in their liabilities and the strategies employed to address them.

Figure 2: Liability key rate duration profile examples2

Source: LGIMA. For illustrative purposes only.

Operating in a high-tide environment

Rising tides pose a number of risks, including the potential for flooding, which impedes road use and increases wear and tear on stormwater and wastewater systems. These dangers can have long-term consequences. Cash balance pension plans appear to be in a period of rising sea levels, and long-term consequences should be considered. One of the dominant headlines of 2022 has been the dramatic rise in Treasury yields as the Federal Reserve attempts to slow the highest inflation in decades. When Treasury yields breach an interest crediting rate floor, the projected account balance is no longer fixed. Instead, it becomes variable, leading to a liability duration that will be lower, possibly close to zero.3

In addition to the reduced interest rate sensitivity, the liability can have unusual yield curve exposures as highlighted in Figure 2. A hedging solution that is appropriate when rates are near or below the interest crediting rate floor may not be appropriate when rates are above the floor. Figure 2 illustrates the potential implications of a floor and the discrepancy between how the liability typically behaves depending on if Treasury yields are above or below the floor (below the floor typically behaves like the Traditional profile and above the floor behaves like the Cash Balance profile). We believe cash balance plans with an interest crediting rate floor require a more dynamic hedging approach, and plan sponsors should begin preparing their hedging programs now, while rates remain below the floor.

Strategies to help mitigate the risk

In anticipation of damaging flooding, coastal communities may upgrade their infrastructure, restore coastal habitats that provide natural flood protection, or modify building standards. It is imperative to be proactive and plan ahead. The same can be said for cash balance plans with a floor, especially now that Treasury yields are likely closer to the floor than they have been in some time.4 It is important to adopt open lines of communication between the plan sponsor, asset manager, investment consultant and the plan’s actuary in order to appropriately understand the risks. Implementing a formal monitoring process and agreeing to an action plan now can be effective for managing the varied risks inherent in a cash balance plan with a floor.

At LGIM America, we advocate for the use of a custom hedging strategy. The more common fixed income market-based benchmarks employed by pension plans may not be appropriate to hedge the risk profile highlighted in Figure 2. It can potentially increase risk rather than reducing it. Exploring a custom liability benchmarking solution can be a prudent exercise for cash balance plans to appropriately manage their unique interest rate sensitivities.

The use of swaptions has often been discussed as a possible solution for managing cash balance plans with a floor. The challenge with swaption strategies can be the cost, particularly when the strike of the floor is close to the current implied crediting rates. In a volatile environment where Treasury rates are fluctuating around the floor, buying and selling swaptions to mirror the liability duration may cause more harm than good. A more pragmatic solution may involve a rigorous monitoring system and a phased implementation approach. The custom nature of the plan’s liability structure often warrants a custom hedging approach. Every situation is unique and should be evaluated in a customized way to account for the objectives and challenges of the plan sponsor.

Surf’s up

Hedging cash balance plans can be complicated, especially when the plan is exposed to credit spread and yield curve risk but not overall interest rate risk.5 Rising interest rates have helped buoy the funded status of many pension plans, in many cases more than offsetting losses in their equity portfolio experienced during the first half of 2022. As market observers watch in anticipation of persistent inflation and continued rate hikes from the Fed, plan sponsors should take action now to make sure their pension plan funded status doesn’t go underwater.

- Additional interest crediting rate methodologies employed by plan sponsors can include fixed rates and rates based on CPI, corporate bond segment rates, or investment returns. In this post, we focus on the implications of cash balance plans with an interest crediting rate linked to the 30-year Treasury yield.

- Liability risk profiles reflect a $1 billion liability present value and are intended for illustration purposes only. The Traditional risk profile assumes 100% final average pay benefits and mirrors a liability with approximately a 12-year duration. The Cash Balance risk profile assumes 100% cash balance benefits and an interest crediting rate linked to the 30-year Treasury yield, resulting in a liability with approximately zero net interest rate duration.

- This is particularly true if the plan’s actuary uses market yields to set the assumption for future interest credits.

- Source: Bloomberg. The last time 30-year yields were near 3.3%, which is the current yield as of June 28, 2022, was in the fourth quarter of 2018.

- The discount rate used to value the pension liability has two components: a risk-free interest rate and a credit spread. Cash balance plans will still be exposed to credit spread risk similar to that of a traditional pension plan, as illustrated in the left side of Figure 2. However, cash balance plans with interest crediting rates tied to market-based yields (for example, when market yields are above a floor) may have no interest rate risk in total, but substantial curve risk as shown in the right size of Figure 2. Corporate bonds, which are typically used to hedge credit spread risk, also carry interest rate risk, so a hedging portfolio that shorts out some or all of the corporate bond portfolio’s duration may be warranted.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity.

Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. Strategies involving hedging, derivatives, futures and commodity interests present substantial risk of loss and are designed for sophisticated investors who are able to beat the risk of capital loss. LGIMA does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.