Pension Debt is Junk

Deferring pension contributions has been common practice among corporate pension plan sponsors since the 1980s. Many sponsors have adopted the approach of funding the minimum required contribution under ERISA and IRS rules. This made perfect sense for many years as it allowed companies to preserve cash, minimize the risk of trapped surplus and free capital to focus on investing in the growth of the enterprise. The practice of deferring funding historically provided a cheap source of financing. Today, it is the financial equivalent of issuing junk bonds.

Historical perspective

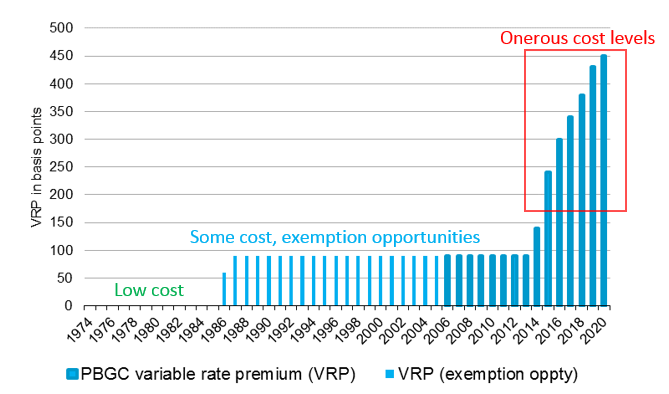

Qualified pension plans have paid premiums to the Pension Benefit Guaranty Corporation (PBGC) since ERISA was enacted in the 1970s. Initially, premiums were negligible so there was no cost savings rationale associated with funding sooner than required. As a result, most sponsors deferred contributions. In the late 1980s, variable premiums based on the level of pension underfunding were introduced. In recent years, these premiums have been increased to much higher levels. Figure 1 shows historical PBGC variable rate premiums (VRP) over time.

Figure 1: Historical PBGC variable rate premiums (VRP) over time

Source: Pension Benefit Guaranty Corporation, LGIMA. Data as of January 2020.

The PBGC VRP has radically changed the financing cost of underfunded pension plans over the last decade. Sponsors should evaluate whether traditional approaches to balancing pension contribution deferral with other debt financing choices still make sense given the large cost increases associated with carrying pension debt.

Source: Pension Benefit Guaranty Corporation, LGIM America. Data as of January 2020.

The PBGC VRP has radically changed the financing cost of underfunded pension plans over the last decade. Sponsors should evaluate whether traditional approaches to balancing pension contribution deferral with other debt financing choices still make sense given the large cost increases associated with carrying pension debt.

Comparing alternatives

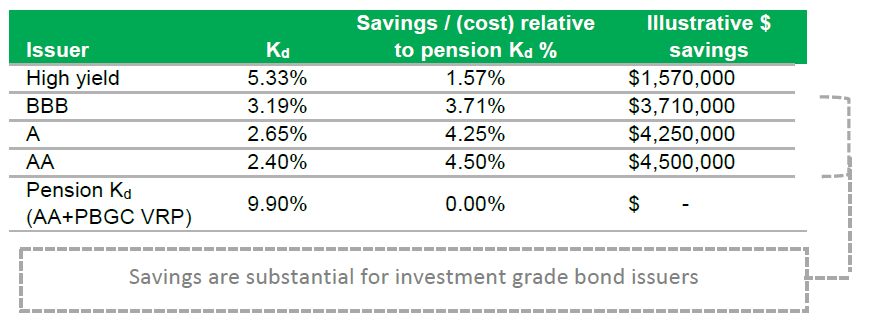

We can compare the cost of financing for various plan sponsors based on their credit rating. We have defined the cost of pension debt (Kd) as the yield on AA bonds (the typical basis for determining pension discount rates) plus the variable rate premium rate (VRP). Figure 2 summarizes the cost of debt for various issuers. The illustrative dollar ($) savings assumes $100,000,000 is borrowed and contributed to the pension plan.

Figure 2: Cost of debt for various issuers

Source: ICE BofAML Indices. Data as of December 31, 2019.

This illustration uses pre-tax amounts. There are additional tax advantages associated with tax deductibility of pension contributions. Notice in Figure 2 that financing cost using corporate debt is clearly cheaper than pension debt for investment grade issuers.

What’s the catch?

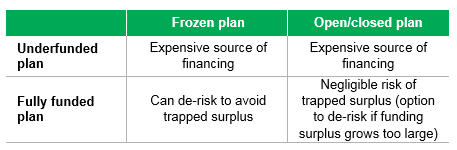

When looking at the table above, the cost savings seem compelling for most plan sponsors/bond issuers. The downside would be if pension contributions led to trapped surplus. While this is certainly a valid concern, the good news is there are some straightforward rules of thumb that sponsors can use to address this risk. Figure 3 summarizes key considerations in assessing this risk.

Figure 3: Key considerations

Concluding comments

The cost of underfunded pension plans has increased dramatically in recent years, creating strong incentives for plan sponsors to rethink choices about corporate leverage versus pension leverage. We recommend revisiting funding and risk mangement approaches to reduce cost without introducing additional or unwanted risk.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of January 2020 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.