2023: The Year of the Pension Hedging Revolution

With pension plan sponsors grappling with so many macroeconomic concerns—inflation, Russia, recession, central bank policy, declining profitability and stretched valuations—2023 is set to be a year of heightened uncertainty. To preserve the hard-earned funded status gains of 2022, plan sponsors should explore the various hedging structures, including capitalizing on short-term tactical opportunities and establishing long-term strategies to shape the plan’s funded status outcomes.

Despite a decline in most public asset classes, 2022 ended with improved funding positions for most corporate pension plans. Interest rates hit their highest points in over a decade, which caused the liabilities to decline more than the assets—especially for more under hedged plans.

Figure 1: Funded status has improved for many plans

Source: LGIM America. For illustrative purposes only. In these scenarios, we assume the return seeking asset (RSA) bucket is composed of a simple S&P 500 allocation, and the liability hedging asset (LHA) allocation is Bloomberg US Long Credit Index. We used a stock set of liability cash flows to approximate a 12-year duration and a present value of $1 billion. We used the Ice BofA A-AAA Corporate Bond Discount Curve to value the representative cash flows. Additionally, on the asset side, we assume quarterly rebalancing back to target weights for the illustrative scenarios.

With ever-present uncertainty around interest rates, inflation, recession, geopolitics and more, we believe 2023 will see many plan sponsors move to preserve their funded status gains and narrow the range of future outcomes through hedging strategies. In this blog post, we highlight three hedging opportunities to evaluate for 2023.

Capitalizing on the inverted yield curve opportunity

Many pension plans have used long-dated STRIPS as a “blunt tool” to add interest rate duration to hedge the liabilities. We say it is blunt because STRIPS do not hedge as well when the yield curve steepens. Fortunately, for those who held STRIPS, the yield curve flattened substantially, and even inverted in 2022 — meaning the strategy has done quite well. And historically speaking, the yield curve tends to steepen dramatically after a Fed rate hiking cycle, as shown below. In other words, now may be an opportune time for plan sponsors holding STRIPS to move to an LDI completion framework and hedge against a potential steepening yield curve scenario.

Figure 2: Historically, yield curve steepens at end of rate hiking cycle

Source: Bloomberg. Data as of December 31, 2022.

Monetizing your glidepath

Implementing glidepath frameworks have been popular investment strategies for over a decade, and we have seen many plans de-risk over the past year due to hitting specified funded ratios and/or interest rate levels. For plans that have not yet reached the end state of their glidepath, we may recommend looking into monetizing the future glidepath triggers by selling payer swaptions.

In this case, the plan would sell payer swaptions, which are options on interest rates, which the buyer could exercise if interest rates rise to a specified level. If rates fall, or stay below the strike price through expiry, the plan keeps the premium paid by the buyer at inception. If rates rise above the strike at expiry, the option will be exercised and the plan enters into a receive fixed/pay floating swap — an action that effectively buys duration, increasing the interest rate hedge, which is in line with the plan’s glidepath.

This strategy is designed to allow the plan to receive an upfront premium while committing to a decision that was already established via their glidepath. Of course, it’s not guaranteed that the plan’s funded status will be better when rates rise, as credit spreads and return-seeking asset performance may offset the gains due to rising rates. It is critical that the plan sponsor explore the strategy in greater detail prior to implementing.

While we believe this strategy makes sense for those on a glidepath in most market environments, periods with higher interest rate volatility may result in a higher premium for selling swaptions (and consequently may also mean there is a higher chance of the swaption being exercised).

Figure 3: Capitalize on higher volatility environment

Source: Bloomberg and LGIM America. Data as of December 31, 2022. The underlying reference rate for swaptions are swap rates, whereas pension liabilities reference Treasury yields, which introduces basis risk. In other words, swaptions introduce additional tracking error into the liability hedging program. It is important to understand the current market environment and the potential risks prior to adopting this type of strategy. This strategy's use of derivatives is designed for sophisticated investors who are able to bear the risk of capital loss.

Reducing equity risk

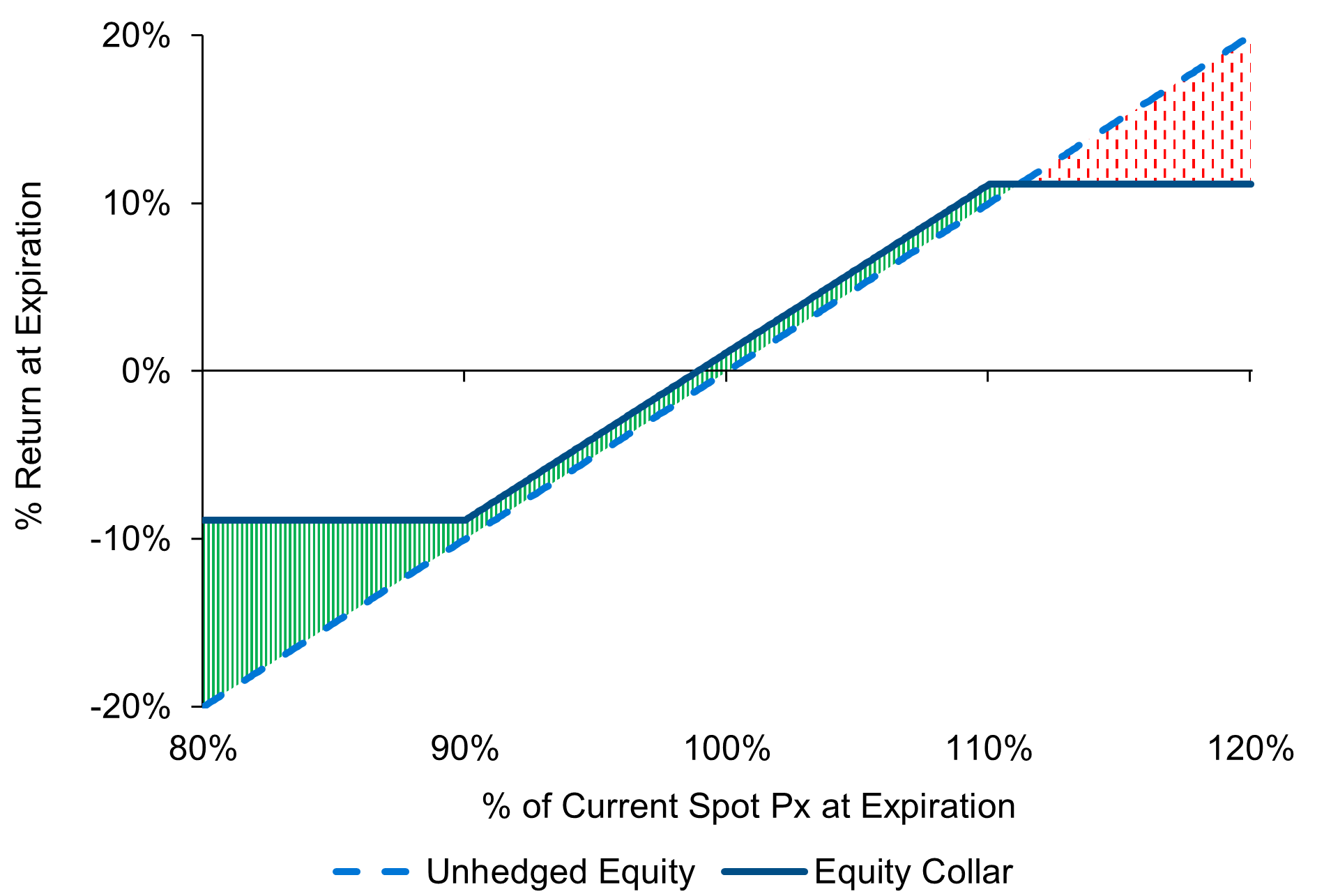

One of the main themes of 2023 is the debate over the timing and severity of the upcoming recession that most market participants seem to be forecasting. Historically, one popular way to protect against equity downside without paying an upfront premium has been to implement a put-spread collar. This allows the plan sponsor to protect against downside equity returns up to a point, while capping the upside.

Today, plans may want to consider a standard collar structure, one that provides unbounded downside protection. In the past, market pricing of standard collars limited upside substantially, but due to increases in interest rates and flattening implied volatility skew, this is not currently the case. Today, it is possible to have a symmetrical collar, providing protection below 90% and allowing gains up to 10% for the next 12 months, while still collecting a small premium. Employing this strategy can narrow potential equity return outcomes for pension plans even as uncertain economic conditions loom.

Figure 4: Illustrative pay-off diagram at expiration

Source: Bloomberg. Data as of January 4, 2023.

With pension plan sponsors grappling with so many macroeconomic concerns—inflation, Russia, recession, central bank policy, declining profitability and stretched valuations—2023 is set to be a year of heightened uncertainty. To preserve the hard-earned funded status gains of 2022, plan sponsors should explore the various hedging structures, including capitalizing on short-term tactical opportunities and establishing long-term strategies to shape the plan’s funded status outcomes.

Disclosures

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

The material in this presentation regarding Legal & General Investment Management America, Inc. (“LGIMA”) is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation, and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. LGIMA does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects LGIMA’s views as of the date hereof and may be changed in response to LGIMA’s perception of changing market conditions, or otherwise, without further notice to you.

Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that LGIMA’s investment or risk management process will be successful.

Hypothetical performance results have many inherent limitations and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Moreover, all hypothetical results are presented gross of fees throughout this presentation.

The use of hypothetical performance is subject to inherent limitations derived from the reliance on historical data and the benefit of hindsight. All trading strategies applied to the analysis were available throughout the performance period. However, the analysis includes certain assumptions where actual performance could be different from the hypothetical performance presented.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.