When History is a Guide – The Case for Commodities Today

The challenges of a half-century ago bear an uncanny resemblance to the risks that we face today. In the 1970s, real returns on traditional 60/40 portfolios were eroded to almost nothing due to a mix of domestic political troubles, conflicts in the Middle East and, most directly, recurring waves of inflation. If this sounds familiar, institutional investors may need to consider allocating to an alternative asset class to preserve portfolio returns. Using history as a guide, we believe commodities may be an appropriate fit.

A brief history

The economic landscape facing the United States in the early 1970s was, to put it softly, challenging. Confronted by the complications of the costs of a hot war in Vietnam and a cold one with the Soviet Union, the Federal Reserve found it difficult to establish a consistent monetary policy to align with shifting political and economic conditions. As a result, the Fed pivoted several times during the decade in what historians now call the “stop-and-go” policies.

Figure 1: Timeline of US economic events (1969 – 1983)

Source: LGIM America. For illustrative purposes only.

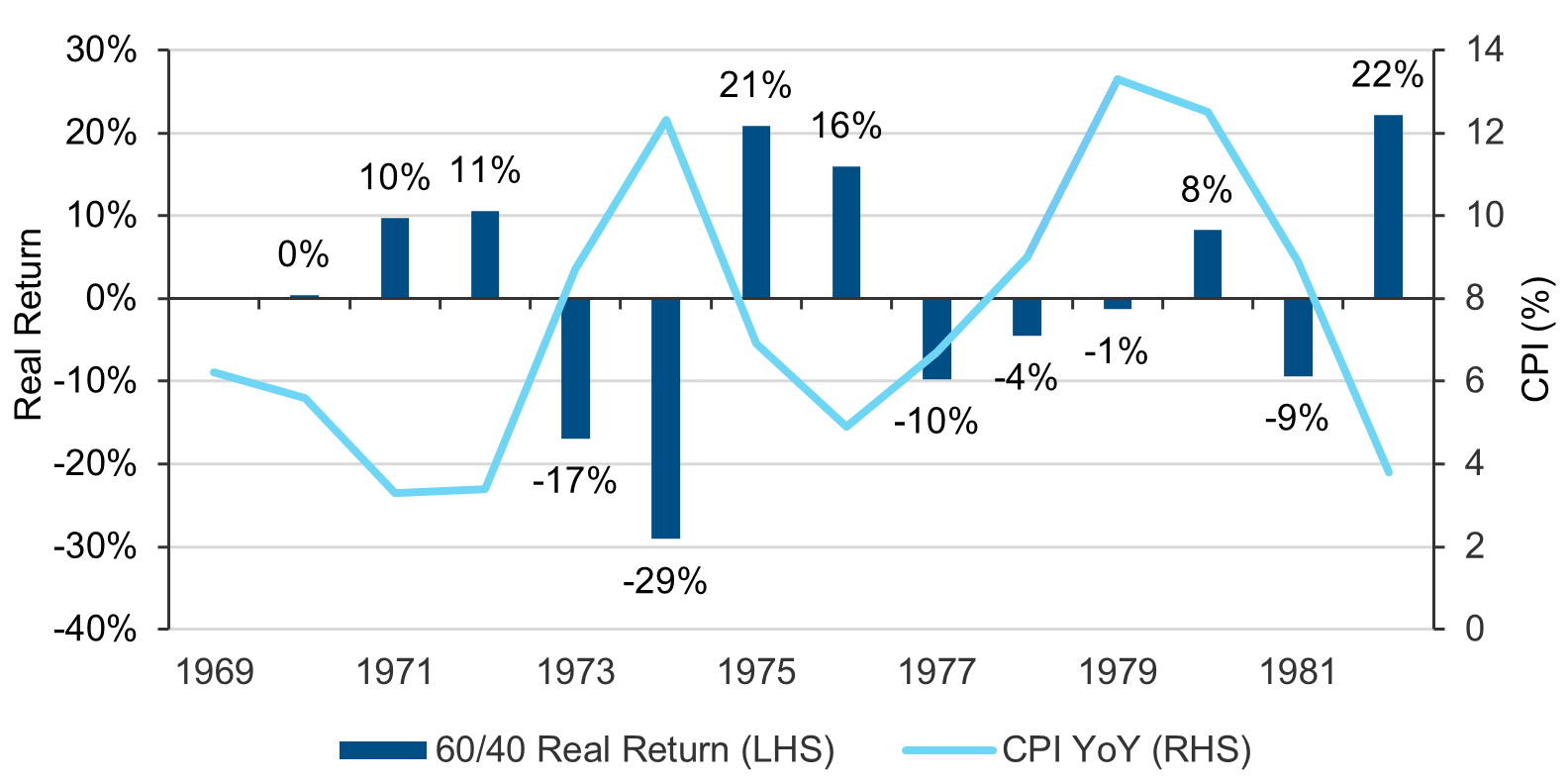

The back-and-forth positioning at the Fed had a tremendous impact on the economy, as policy was not sufficiently tight enough to quell long-term inflation . In addition, policy mismanagement substantially restrained traditional investor returns. By virtue of the several recessions and two substantial inflationary waves brought on by the stop-and-go policies, the real return on a 60/40 portfolio was a paltry 0.19% per year from 1969-1982. At the same time, however, commodities experienced substantial real returns of 15.10% per year, driven at first by the energy supply shock, and then during the second inflationary wave, by gold.

Figure 2: 60/40 Portfolio returns and inflation (1969-1982)

Source: Bloomberg, JP Morgan Asset Management.

Figure 3: First inflationary wave (1973-1974) – Annual returns

Source: Bloomberg.

Figure 4: Second inflationary wave (1977-1979) – Annual returns

Source: Bloomberg.

The strong rhymes of history

Though not exact, it’s hard not to notice the substantial similarities between the economic and political circumstances of today and of a half-century ago. Proxy conflicts with Russia, ongoing wars in the Middle East and a bitterly divided government and electorate dominate the headlines today as they did in the 1970s. But perhaps the most striking resemblance is reflected by the current economic situation and expected path forward.

In 1975, the Federal Reserve eased policy with inflation on the decline. The subsequent money supply growth drove inflation slowly higher at first, until expectations became de-anchored and inflation exploded. Now, following an eerily similar disinflationary trajectory, market participants are betting that the Fed will begin easing with a series of interest rate cuts beginning as soon as March. The question remains: if the Fed follows through, will it have kept policy restrictive enough to avert another inflationary relapse, unlike 50 years ago?

Figure 5: Consumer Price Index (year-over-year)

Source: Bloomberg, Apollo Global Management, The Kobeissi Letter.

Figure 6: Market-implied Fed Funds Rate

Source: Bloomberg. Data as of December 29, 2023.

An appealing hedge amidst today’s uncertainty

While it is impossible to predict the future, it is worth looking to history to create a plan for potential outcomes. If the Fed does, indeed, move too early, it is possible that excessive monetary growth could lead to de-anchored inflation expectations as it did in the late 1970s. Therefore, we believe institutional investors should consider an allocation to a diversified basket of commodities. This could increase the resiliency of the portfolio and, if history is a guide, the asset class may be well positioned to outperform in this scenario.

To address this, we have designed a commodities strategy that offers investors several key features:

- Efficient exposure to a diversified commodities benchmark.

- TIPS exposure to deliver real yield returns.

- Overweighted exposure to gold, which we believe may offer an incremental hedge to geopolitical uncertainty, monetary policy decisions and recurrent inflation.

Lastly, this strategy seeks to provide equity-like returns at a reduced correlation to both US and global stocks over the long term, possibly providing diversification benefits with minimal opportunity cost. Specifically designed with efficiency and inflationary concerns in mind, we believe our strategy may help institutional investors prepare for the risks ahead, especially if history is a guide.

For more information on this strategy, including performance and fees, please reach out to our team.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

In certain strategies, LGIMA might utilize commodity interests and derivative contracts which inherently present substantial risk of loss and a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.