LGIM Dials up Its Engagement on Climate

Window to Achieving 1.5 Degrees Rapidly Closes

LGIM releases annual Climate Impact Pledge results, with its exclusion list expanded to cover almost £158 billion of assets

- Climate engagement program now covers over 5,000 companies in climate critical sectors

- During the 2023 proxy season, 342 companies were subject to voting sanctions due to poor climate change standards

- 14 companies are subject to divestment having failed to meet LGIM’s red lines, with two new additions to this year’s list

- China Mengniu Dairy removed from exclusion list following progress

- The Oil & Gas, Banking, Insurance and Property sectors continue to lag when it comes to setting and meeting net-zero targets

June 15, 2023 - Legal & General Investment Management (LGIM), one of the world’s largest asset managers, has today announced the results of its seventh Climate Impact Pledge – its annual engagement program to encourage companies to tackle climate change and the transition to net-zero carbon emissions.

As the window to limit global warming to 1.5 degrees narrows, LGIM has this year expanded the scope of the Climate Impact Pledge, holding more companies to account than ever before through voting and investment sanctions. It is now assessing 5,000+ companies across 20 climate critical sectors, a significant step forward from the circa 1,000 companies across 15 sectors in last year’s Climate Impact Pledge.

As a result of this expanded approach, LGIM has identified 299 companies through its quantitative analysis that qualify for AGM voting sanctions for not meeting its minimum standards to address climate risk.

In addition to its quantitative assessment, LGIM has conducted more targeted and direct engagements with 105 ‘dial mover’ companies, a 75% increase from the 60 companies identified in 2021. ‘Dial-mover’ companies are chosen for their size and potential to galvanize action on climate in their sectors. Engagement is usually year on year as LGIM encourages change, with consequences including voting sanctions and, for applicable funds, divestments.

LGIM will apply voting sanctions against 43 of these dial movers, including those companies on the divestment list.2 12 companies remain on LGIM’s divestment list. These companies are AIG, China Construction Bank, China Resources Cement, Exxon Mobil, Hormel, Industrial Commercial Bank of China, Invitation Homes, KEPCO, Loblaw, MetLife, PPL and Sysco.

LGIM has also announced two further divestments from companies that are failing to meet its standards on climate - Air China and COSCO Shipping Holdings - taking the total number of companies on LGIM’s divestment list to 14.

In a positive development, China Mengniu Dairy has been reinstated. Following direct engagement, the business has now published a deforestation policy, committed to carbon neutrality by 2050, and delivered on LGIM’s red lines.

Commenting on this year’s Climate Impact Pledge, Michael Marks, Head of Investment Stewardship at Legal & General Investment Management said:

“As the window for achieving a 1.5C outcome by 2050 narrows, the need for greater action by companies has become increasingly urgent. Companies which are too slow to act are contributing to systemic risk. It is imperative that investors play their part, by expanding and deepening the scope of their climate engagement, and encouraging companies to scale up their ambitions and reduce real world emissions. This is what LGIM is doing.

“From tackling climate lobbying to incorporating biodiversity risk, our expectations of companies are increasing - insufficient progress represents a systemic challenge which we will continue to challenge through the tools at our disposal, including divestment and voting sanctions.”

Addressing the need for urgency in tackling climate change, Michelle Scrimgeour, CEO at Legal & General Investment Management said:

“There has never been a more important moment to address the generation-defining challenge of climate change. And yet, after a year of geopolitical and economic upheaval, global efforts to spur the energy transition are wavering. We believe policymakers, investors and industry leaders must use every legitimate tool at their disposal in order to mitigate the systemic risk posed by climate change. Every part of the global economy needs to adjust.

“As a responsible investor, it is incumbent upon us to signal clearly to investee companies the actions we expect them to take to drive up market standards. Initiatives like our Pledge play a key role in this activity and demonstrate how we seek to fulfil our purpose: to create a better future through responsible investing. At this critical juncture, it is imperative that we all step up. Change is still possible – if we act now. The world has the means; it just requires the will.”

Pledge expanded to incorporate biodiversity risk and climate lobbying activity

LGIM has not only expanded the scale of its pledge, but the expectations that underpin it, with a greater focus now placed on the link between biodiversity and net-zero strategies, as well as climate lobbying activities.

- LGIM’s expectations for ‘dial-mover’ companies now include:

- LGIM expects to see comprehensive, certified net-zero emissions targets, including disclosing a transition plan with short and medium-term targets

- Companies must disclose the actions and investments embedded in their plan to reach net-zero

- LGIM expects each company to disclose whether its executive remuneration is aligned with the company’s short and / or medium-term emission targets

- To achieve the policy environment requirement in the Paris Agreement, LGIM has set a ‘red line’ for all sectors on the disclosure of climate lobbying activities, including trade association memberships, and explaining what actions it will take if the lobbying activities of these associations are not aligned with a 1.5°C scenario

- LGIM emphasizes the importance of combating biodiversity and nature loss, and integrating social implications, in delivering a credible pathway to net zero:

- For sectors with a clear link between biodiversity and net-zero strategies, companies should assess their impacts and dependencies with a view to managing risk, as well as mitigating and reversing negative impacts

- For sectors where the transition could have direct social implications, LGIM expects companies’ decarbonization strategies to incorporate a ‘just transition’ perspective

Oil & Gas fails to meet LGIM’s standards

Despite record oil & gas profits, over a third of companies in the sector failed to meet our minimum standards and most did not have sufficiently ambitious emissions targets.

The Banking, Insurance and Property sectors have also been singled out as lagging when it comes to setting and meeting ambitious net-zero targets.

LGIM notes that these industries have the power to lead the way in reallocating capital and decoupling economic growth from carbon emissions.

Figure 1: % of companies with minimum standards per sector and those with ambitious GHG emission targets

Source: Source: LGIM, as at April 2023. The height of the bar represents the % meeting minimum standards within each sector. The light green squares denote the percentage of companies in each sector with ambitious targets - We consider ambitious to be a 1.5°C aligned or well-below 2°C aligned emissions reduction target. For illustrative purposes only.

List of ‘climate critical’ sectors expands

The number of ‘climate-critical’ sectors has increased from 15 to 20, now including Forestry and Paper & Pulp, Aluminum, Glass, Logistics and Multi-utilities.

As a result, higher standards and more urgent action will be required from these companies. However, LGIM notes that a number of these newly included sectors such as Aluminum, Glass and Forestry lead the way in terms of the scale of their ambition and meeting LGIM’s minimum standards.

Europe and UK lead on climate targets, with improvements in Asia

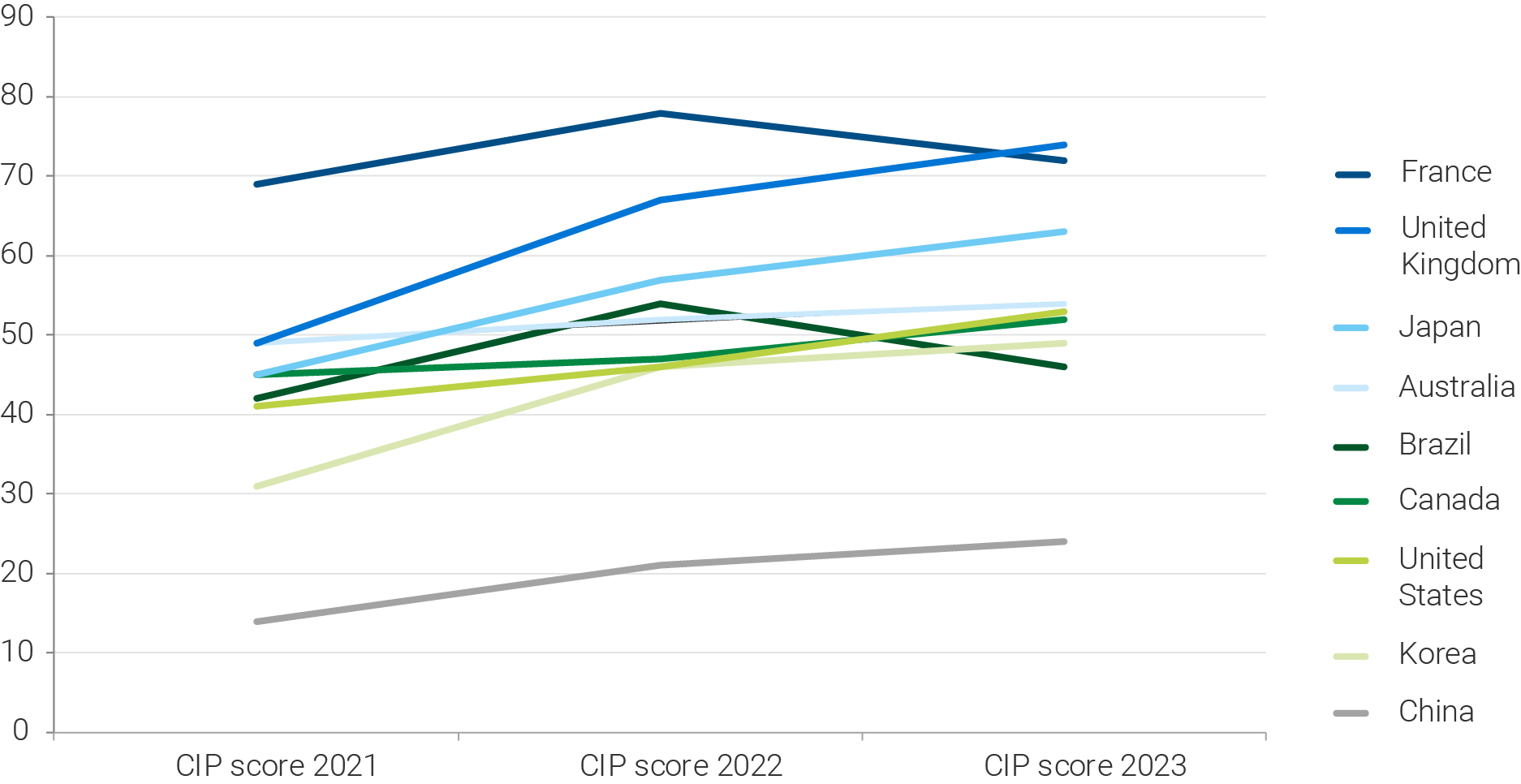

While UK and France still lead the pack, out of select countries shown on the chart, Korean and Chinese companies have seen the most significant improvements. Japan also saw notable improvement between 2021 and 2023.

Although the US has improved its average scores year on year, progress remains one of the slowest compared to other geographies.

Figire 2: Historical average CIP ratings in select countries (2021-2023)

Source: LGIM, as at April 2023. The selection of companies remains consistent across three years for comparability purposes and the scope does not include the expanded universe for 2023 data. For illustrative purposes only. In the chart, we compared the original CIP universe of c. 1000 companies from 15 sectors, based on the MSCI ACWI index, which captures global large- and mid-cap companies (including for 2023’s score, to make it comparable with previous years). We see an upward trend among larger companies, with Asian countries showing highest improvements in terms of average scores. With climate data becoming more available, our CIP scores have evolved to integrate new data points. Even when we account for 2023’s expansion, with the additional data points in our methodology, we still see an upward trend among most countries.

LGIM continued to see positive response rates to its global direct engagements, witnessing an 80% response rate this year from its dial mover companies, up from 78% in 2022.

Companies in emerging markets (including China, India and Malaysia) were less responsive to LGIM’s request to engage on climate issues. Among 21 non-responsive companies, 13 (62%) were in emerging markets.3 When companies are unresponsive to our engagement requests, we assess their performance using the company’s public disclosures and external sources.

Press contact

Carolyn GasbarraEdelman

Carolyn.Gasbarra@edelman.com

O: 630.220.0017

1. As of December 31, 2022.

2. Where exclusions cannot be applied, we apply a vote sanction.

3. We engaged with 105 companies, 21 did not respond.

4. LGIM internal data as of December 31, 2022. These figures include assets managed by LGIMA, an SEC Registered Investment Advisor. Data includes derivative positions.

Disclosures

For professional clients only. Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an LGIM portfolio. Views expressed are of LGIM as of June 15, 2023. The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities. © 2023 Legal & General Investment Management Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, without the written permission of the publishers.

About Legal & General Investment Management (LGIM)

LGIM is one of Europe’s largest asset managers and a major global investor, with total assets under management of £1.2 trillion4 ($1.4tn, €1.4tn, CHF 1.4tn). We work with a wide range of global clients, including pension schemes, sovereign wealth funds, fund distributors and retail investors.

For more than 50 years, we have built our business through understanding what matters most to our clients and transforming this insight into valuable, accessible investment products and solutions. We provide investment expertise across the full spectrum of asset classes including fixed income, equities, commercial property, and cash. Our capabilities range from index-tracking and active strategies to liquidity management and liability-based risk management solutions.