Markets Catch a Cold

Global markets have caught a cold. Fears of a Coronavirus pandemic are prompting employers to suspend business travel, emptying the shelves of grocery stores across the US, and causing investors to look for immunity in Treasuries. For defined benefit pension plans the prognosis could be grim.

Big sell-offs in return seeking assets along with plunging US rates, including a drop of more than 10% in the S&P 500 and a rally of more than 25 basis points in the 30-year US Treasury rate within the span of one week, have already resulted in significant erosions to funded status. Depending on how the virus outbreak progresses, the prospect going forward could be even worse.

Figure 1 below demonstrates the funded status erosion for three illustrative plan allocations during the one week period over which fears of global pandemic escalated.

Figure 1: Funded status erosion illustration over one week

|

% Equities |

Interest Rate Hedge |

Funded Status Decrease |

|

|---|---|---|---|

|

Allocation 1 |

70% |

30% |

-10.60% |

|

Allocation 2 |

50% |

60% |

-7.20% |

|

Allocation 3 |

30% |

100% |

-3.50% |

Source: Bloomberg, February 27, 2020

As the 10-year US Treasury rate breached a historic low of 1.31% on Tuesday, and has continued to creep lower ever since, many allocators are questioning whether the move is overdone or just getting started. The more important question may be whether the pain associated with a further move down in rates is tolerable.

While Treasury yields are at historic lows in the US, it may be tempting to think that they have hit a floor. It would be prudent, however, to first consider them in the context of the rest of the world before drawing a conclusion. Relative to its G-7 peers, US rates are in fact relatively high.

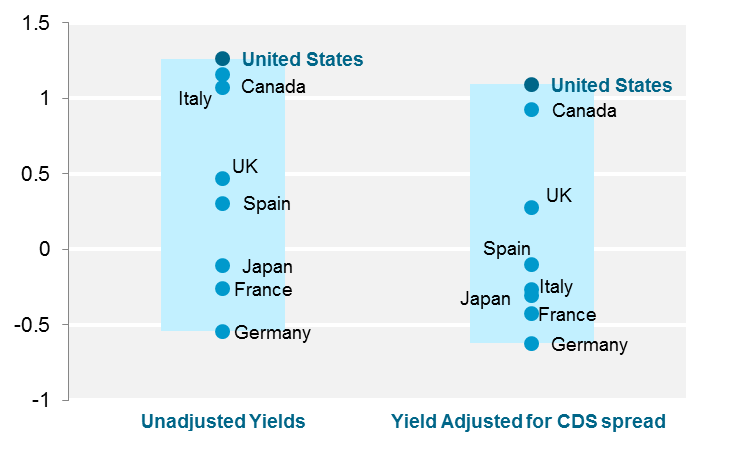

The graph on the left side of Figure 2 below illustrates where 10-year US Treasury rates stack up versus other developed countries. The graph on the right side depicts where they stack up when adjusted for the credit risk associated with the sovereign bonds of these peer countries (using 5-year CDS spreads as a measure). While US rates are low in absolute terms, both illustrations suggest that they may not be as low as they seem from a relative point of view.

Figure 2: Yields on global 10-year sovereign bonds

Source: Bloomberg, February 27, 2020. For illustrative purposes only.

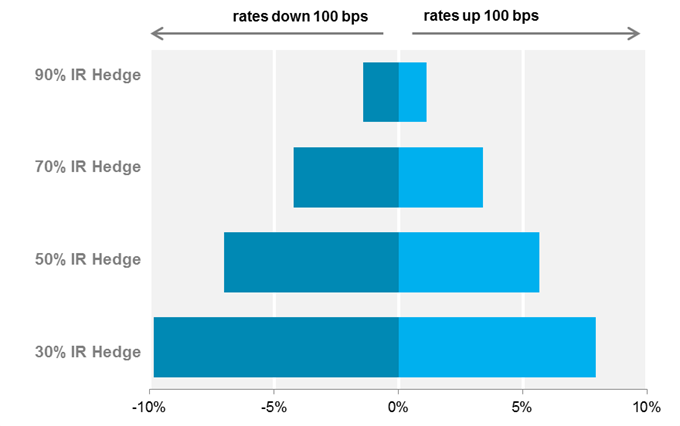

The other painful side effect of rates as low as they are is convexity. Given the mathematical reality of interest rate sensitivity, any further reduction in interest rates will result in a proportionally larger increase in pension liabilities than a liability decrease due to an equivalent magnitude increase in rates. Figure 3 below quantifies the impact on funded status position given 100 basis point shocks to interest rates for an illustrative $500 million plan with a duration of approximately 12 years.

Figure 3: Asymmetric funded status impact of 100 basis point interest rate shocks

Source: LGIM America. For illustrative purposes only.

Taking into consideration the potential for further rate declines alongside the looming threat of pandemic continuing to spook equity markets, we are starkly reminded that interest rates are uncompensated risks. Plans sponsors may want to reaffirm their asset allocations and understand their prospective downside risk in light of the potential that outbreak fears fail to abate. How badly could our funded status decline and can we manage this impact? Buying more fixed income and hedging more interest rate risk today would be an expensive decision given recent market moves. While this vaccine may be expensive now, the cost of inaction could lead to a more serious illness.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of February 2020 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.