Unlocking the Power of a Strategic Allocation to Commodities

As a standalone asset class, commodities have recently been uninspiring to investors, even after the inflationary period that followed the pandemic. Investors seem to have two primary concerns for maintaining a strategic allocation to commodities: (1) Commodities became a strategic allocation for many institutions after the spike in prices prior to the GFC but have delivered lackluster absolute returns since then and (2) Inflation is episodic, and it is unnecessary to hold strategic exposure to combat this. However, when we look at the combination of current market themes and historical contributions of commodities to a balanced portfolio, we see ample reasons to allocate to this unloved asset class.

In this article, we address concerns about commodity returns and highlight the significant, often overlooked, diversification benefits of this asset class beyond just inflation. We also share our current inflation outlook, which remains a relevant and timely topic.

The Fall of 2024 was a cornucopia of macroeconomic uncertainty and anxiety. Ongoing Fed policy normalization with good-but-volatile growth data are generating a wider than usual range around forecasters’ outlooks. The new administration in the US is poised to be able to enact a broad range of policies that are currently expected to keep longer-term inflation more elevated. Each step toward policy normalization seems to make markets more nervous about the Fed’s calibration, and each geopolitical question that gets resolved seems to be replaced by two more.

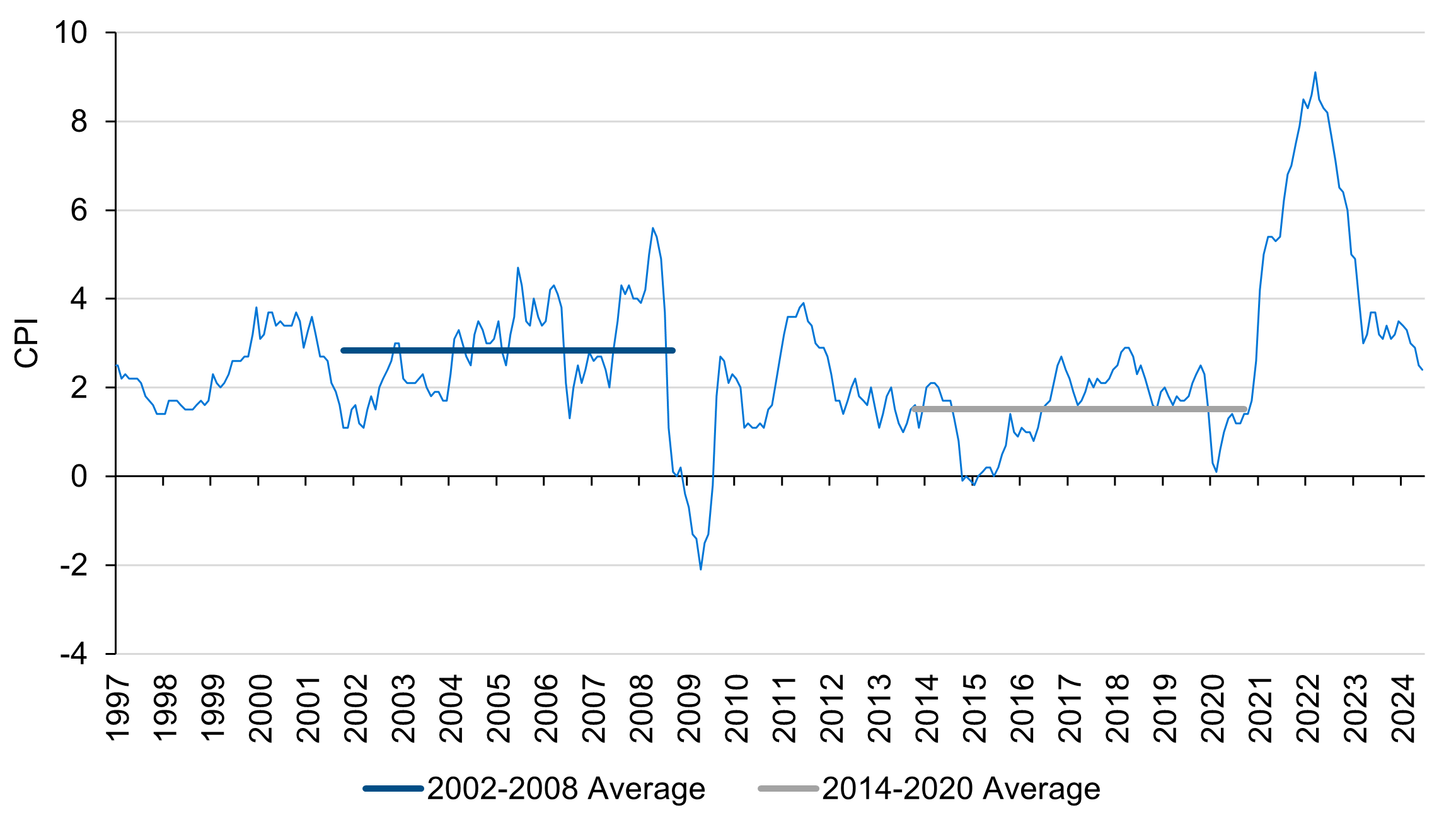

Regardless of the near-term uncertainty, consensus and our own longer-term expectations indicate inflation settling into a range significantly higher than the disinflationary, “zero interest-rate policy” world that followed the GFC (see Figure 1). The prospect of a material shift in inflation is consistent with several themes in commodity markets: managing the energy transition, electrification and computing power requirements of industrial metals, global central bank policies and increasing reserves in gold and geopolitical and weather risks that affect multiple sectors. This suggests a supportive environment for prospective commodities returns. Yet, the most powerful argument for commodities is that their stand-alone returns don’t actually need to be that exceptional.

Figure 1: US core inflation and consensus forecast

Source: Bloomberg and LGIM America. Data as of September 30, 2024.

For practical purposes, commodities tend to be accessed synthetically by institutional investors. To illustrate an efficient commodity exposure alongside stocks and bonds, we utilize a blend of broad commodity exposure plus an explicit overweight to gold, fully collateralized with market exposure to US TIPS.1 Utilizing TIPS as collateral enhances the focus on real returns, and exposure to the full TIPS market avoids some unappreciated risks of concentrating TIPS in short durations.

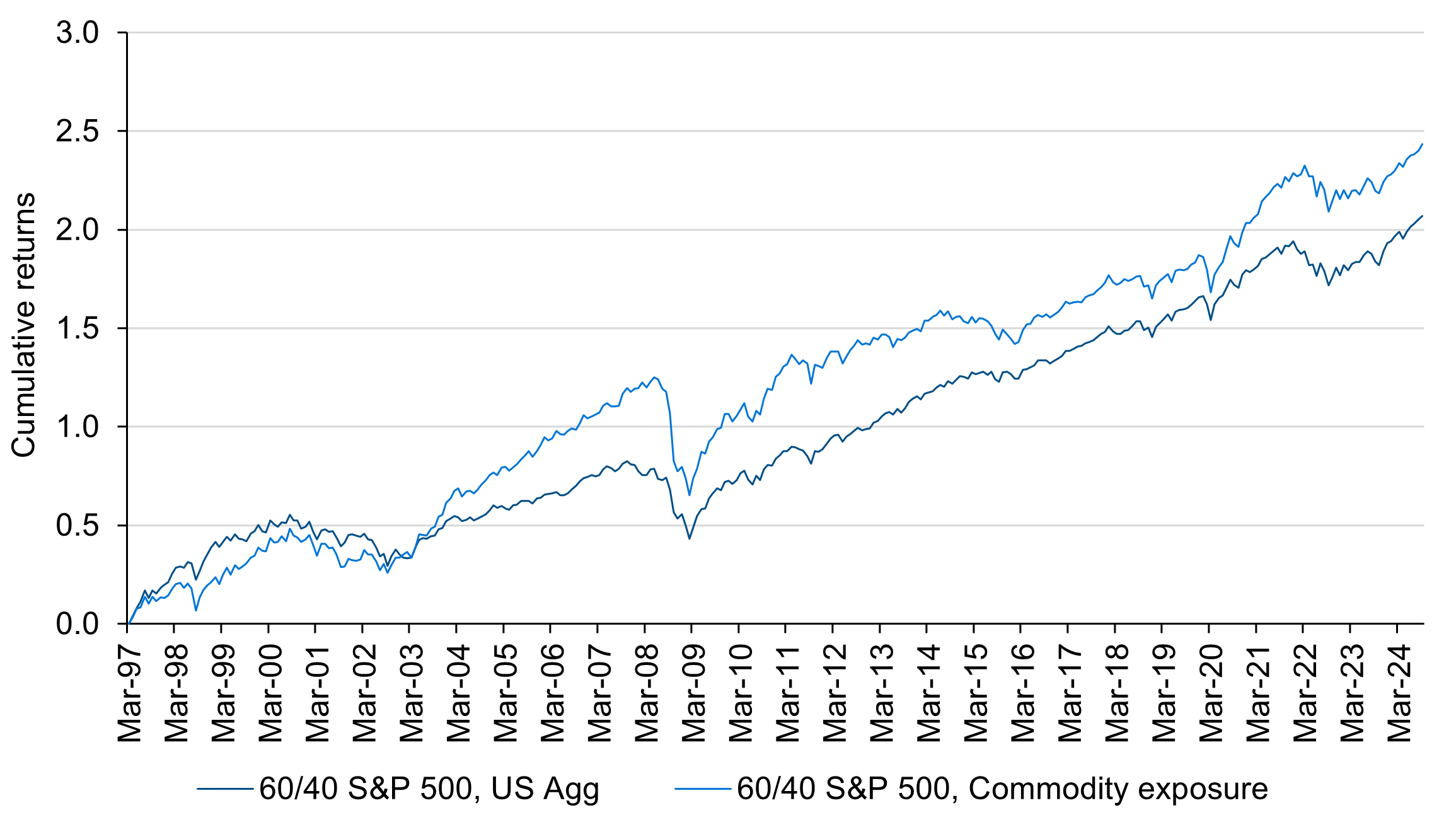

Figure 2 illustrates this with a relatively extreme asset allocation example, comparing the return of a traditional 60/40 portfolio allocated to S&P 500 and the US Aggregate to a 60/40 portfolio of S&P 500 and the blended commodity exposure. Not only are the total returns of the portfolio allocated to commodities better than the portfolio allocated to core fixed income over most horizons, but also the Sharpe Ratios over most of those horizons are better (i.e., it is a more risk efficient portfolio).

Figure 2: Cumulative total returns

Source: Bloomberg and LGIM America. Data as of September 30, 2024. See performance details in appendix. Commodity interests and derivative contracts inherently present substantial risk of loss and a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

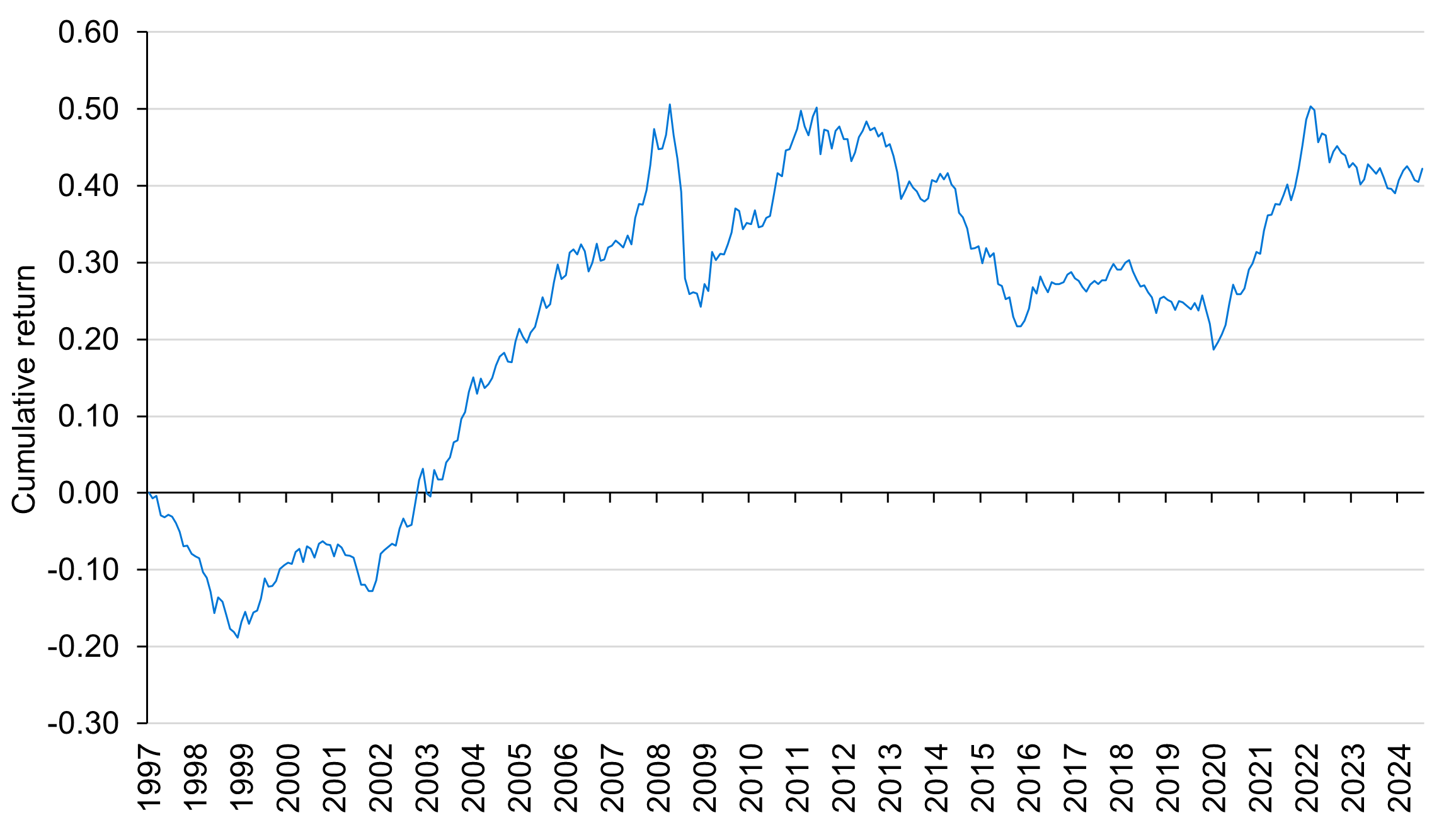

Reconciling this hypothetical portfolio with the recency bias contributing to investors’ aversion to commodities is relatively straightforward. Figure 3 is the cumulative difference in the contribution of a 40% allocation to the commodity exposure versus a 40% allocation to US Agg. There are several important observations, but the primary insight is commodities simply diversifies risks differently than core fixed income.

Figure 3: Cumulative performance contribution of a blended commodity exposure

Source: Bloomberg and LGIM America. Data as of September 30, 2024. See performance details in appendix. Commodity interests and derivative contracts inherently present substantial risk of loss and a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

First, we acknowledge that much of the outperformance of the commodities allocation is derived from the period from 2002-2008. Although, conspicuously, this coincides with an era of materially higher average inflation than what we experienced prior to the pandemic, as shown in Figure 4.

Figure 4: CPI year-over-year change (%)

Source: Bloomberg and LGIM America. Data as of September 30, 2024.

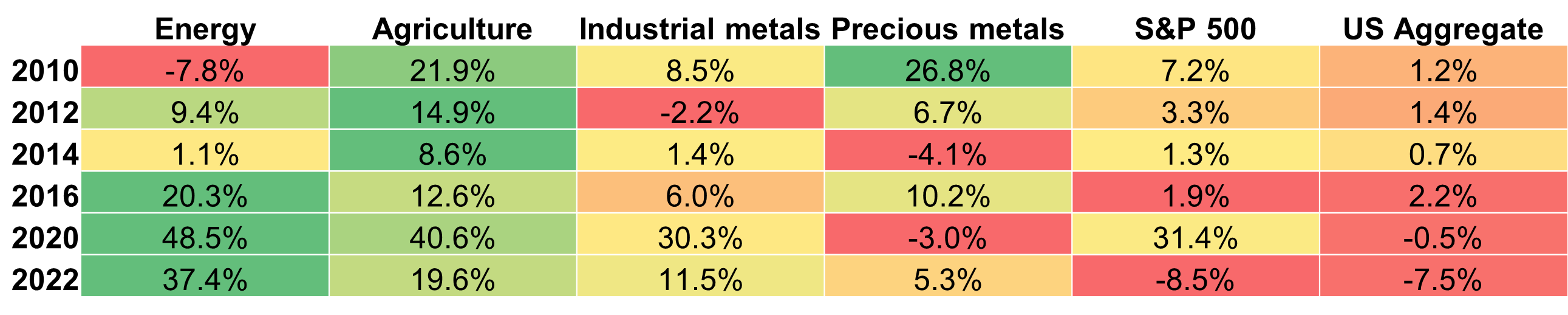

Second, the modest improvement of commodities over the Agg more recently (e.g., 0.6% annualized over 10 years) has been uneven. Interestingly, there is nothing exceptional about the performance of Agg during the periods of significant commodity outperformance or underperformance. The relative difference is driven by commodities’ co-behavior with equities during those periods. This reiterates our point that neither asset class (commodities or core fixed income) is a better equity diversifier--they are just different. Figure 5 highlights some of the historical performance differences during recent periods of heightened macro and geopolitical volatility.

Figure 5: Historical performance differences in volatile periods

Source: Bloomberg and LGIM America. Data as of September 30, 2024. The most volatile periods highlighted in the table were determined using the volatility of the Bloomberg BCOM index since 2010.

Broad commodity exposure gives investors access to four distinct sectors that each relate to the real, material world differently, in both sources and uses. Each sector diversifies significant risks in unique ways.

| Sector | Risk |

|---|---|

| Energy | Geopolitical, as well as its direct link to inflation |

| Agriculture | Geopolitical and climate |

| Precious metals | Fiscal and monetary policy, geopolitical risk related to trends in globalization |

| Industrial metals | Growth risks, given their foundational linkages to computing power and electrification |

Recently, external events have increasingly influenced returns and volatility in the commodity market, often in ways that many investors overlook. Most apparently:

- Conflict in the Middle East drives spikes in energy prices.

- Ongoing conflict in Ukraine and local weather there are affecting both energy and agriculture markets, particularly wheat.

- Weather volatility is complicating price action in other agricultural commodities in the western hemisphere and impacting North American energy hubs.

- The impact on energy in the Caucasus and the Gulf of Mexico cascades to fertilizer and biofuel markets, creating a feedback loop with the agricultural markets already at risk in those regions.

- Nervousness about deglobalization coupled with a longer and more uncertain policy normalization have made precious metals an exceptional performer of late.

- The world is grappling with longer timelines for energy transition, partly due to challenges sourcing industrial metals critical for computing and electrification.

In our view, these are all sustainable trends and persistent risks. Of course, other asset classes offer return and diversification benefits. Yet none is as closely tied to the fundamental macroeconomic dynamics shaping our future as commodities. While a 40% allocation to commodities may be a bridge too far, they are fundamental to our existence, and there has always been a case for them in investment portfolios—perhaps now more than ever.

1. The hypothetical illustration is based on an allocation of 80% Bloomberg Commodity Roll Select Index, 20% Bloomberg Gold Sub-index, and 100% Bloomberg US TIPS Index (representing the collateral).

Appendix - Index returns (1998 - 2024)

*Assumes 0.09% p.a. financing fee for BCOM Roll Select, 0.06% p.a. financing fee for BCOM Gold. A 0.15% p.a. model management fee is applied to the entire strategy.

Disclosures

Commodity interests and derivative contracts inherently present substantial risk of loss and a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

The material in this presentation regarding Legal & General Investment Management America, Inc. (“LGIMA”) is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation, and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. LGIMA does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects LGIMA’s views as of the date hereof and may be changed in response to LGIMA’s perception of changing market conditions, or otherwise, without further notice to you.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.