A Cautionary 'Green' Tale

Over the past five years, the market has seen an explosion in the issuance of sustainable debt (i.e. use-of-proceeds bonds also known as green, social or sustainability bonds, and more recently sustainability-linked bonds). Some proponents have heralded these securities as an innovative response to challenges faced by capital markets, seeking to mobilize debt towards projects or assets that can help achieve positive environmental and social outcomes. However, it is important for fixed income investors to remember money's inherent fungibility and also evaluate the issuer holistically from an ESG lens. How sustainable is a sustainable bond from an issuer with overall poor ESG scores? This strikes us more as an act of the proverbial putting lipstick on a pig.

Going green: a closer look at trends in issuance

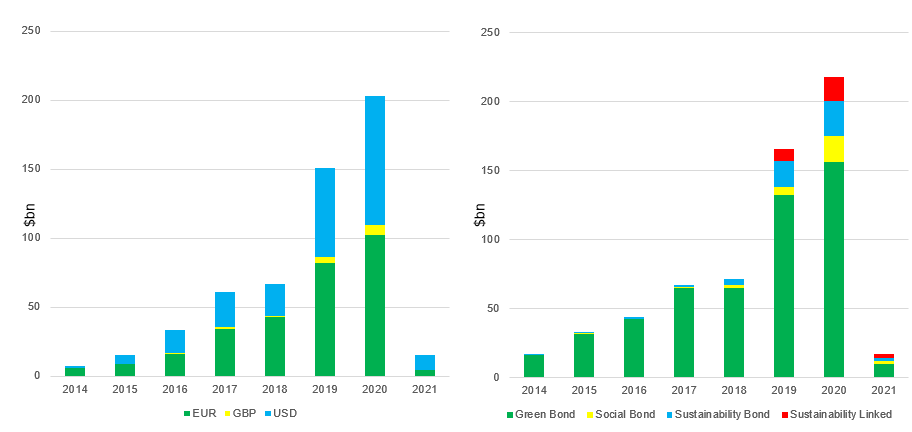

The market has now gained traction: by the end of 2020, total sustainable debt outstanding had passed the $1 trillion mark.1 This is no longer a market dominated by sovereign and sub-sovereign issuers: in 2020 corporate debt represented approximately 30% of total issuance. The breadth of issuers has also increased significantly. While the issuance of this debt was once predominantly the remit of banks and utilities, we are seeing an increased breadth of issuance across sectors. Since 2014, our data suggests that banks and utilities represent approximately 70% of corporate sustainable bond issuance. However, 2021 illustrates how this trend is changing, with the number closer to 50% by the end of January 2021. Figures 1 and 2 below illustrate the issuance trends and relative size of this market.

Figure 1: Trends in issuance

Source: LGIM, Bloomberg, February 2021. All data is shown in USD. Data based on Bloomberg fixed income search (SRCH) filtered by corporates, GBP/EUR/USD only, and green, social, sustainable and sustainability linked indicator.

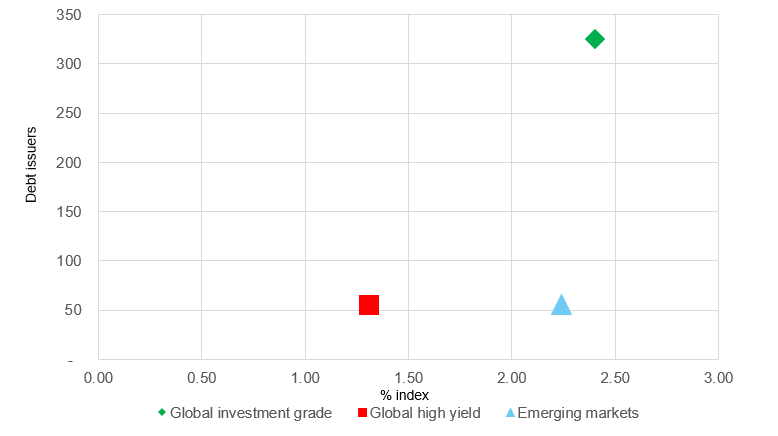

Figure 2: Sustainable debt in the GFI universe

Source: LGIM, Bloomberg, February 2021. All data is shown in USD. Exposure based on Bloomberg green, social, sustainable and sustainability linked indicator. Indices used: Barclays Capital USD/EUR/GBP Corp 1% issuer capped index, ML Global HY BB-B 2% Constrained ExFin (hedged to USD), 50% JPM EMBI Global Diversified, 50% JPM CEMBI Broad Diversified Index.

Proceed with caution

In active credit, sustainable debt has also become an increasingly larger part of the investable universe, and we expect this to continue in 2021.

This unabating trend has offered a moment of reflection to remind ourselves of the purpose of capital markets which is, ultimately, to facilitate the efficient allocation of capital. Excess levels of demand over supply have created problems in the past when the system’s response to this imbalance has been to create new debt instruments to allow money to flow into markets. This is intended to satisfy investors’ exposure requirements at the time, to lower the cost of funding for borrowers, and provide fee income for the facilitators. Everyone’s a winner, right?

Unfortunately, we have witnessed this conflict of interest time and time again throughout financial history – and rarely does it end well. From the tech IPOs that came thick and fast in the late 1990’s fueling the "dotcom bubble," to the creation of RMBS, CLOs and CDOs that were involved in the global financial crisis – most, if not all readers, will remember how that ended.2 The threat of massive loss of principal isn’t as great, in our opinion. However, there is a risk of a misallocation of capital and a failure of achieving the desired sustainability outcome if investors do not pay close attention to the structure of these securities.

If structured properly, green bonds, or debt issuance related to ESG factors, should tick a lot of boxes for investors, given the significant momentum behind this industry trend. Their current popularity can be seen in the premium or “greenium” at which these bonds are being issued, compared with a company’s existing debt. However, if linked to the wrong projects or targets, these green bonds risk becoming at best an irrelevance or at worst a smoke screen attempting to mask a company’s true ESG credentials.

This capital access channel is simply too important to suffer a similar fate. We are all acutely aware of the enormous responsibility business has to play in the transition to a more sustainable, low carbon economy. As part of a global enterprise, we have taken this responsibility seriously for over two decades and our stance remains firm; part of our role is to aim to use our influence to ensure sustainable bond proceeds (whether green or social) are appropriately deployed by the issuing company. More importantly, in sustainability-linked bonds, the terms and conditions of what companies sign up to should not be left to the issuing companies and their bankers. It is imperative that those investors putting their capital at risk have a strong say in what constitutes a genuine improvement in the sustainability profile of a company.

The biggest success of the sustainable bond market has been the increased transparency, disclosure and dialogue on ESG topics. We believe that in the long-run, broader efforts within the ESG market to standardize disclosure and build consensus on a sustainable taxonomy of activities for each sector will create less reliance on bond labels overall.

In the meantime, proceed with caution.

1. Please note, the figure of $1trn relates to the entire market labelled as “debt”, whereas the figures in the charts above refer to our investable universe within the stated parameters.

2. Initial Public Offering, Residential Mortgage-Backed Securities, Collateralised Loan Obligations and Collateralised Debt Obligations.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of March 2021 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.© 2020 Legal & General Investment Management Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, without the written permission of the publishers.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.