Don’t Underestimate Overlays - Demystifying Overlays Can Lead to Better Outcomes

Strong investment risk management is paramount for plan sponsors in normal market conditions, further magnified by the events of 2020. It often starts with a top-down approach establishing the strategic target asset allocation (SAA). Implementation then revolves around creating a governance framework to efficiently achieve the SAA. This approach has become best practice as investors have spent more time on their SAA and looked to reduce investment management costs throughout their implementation.

What is not as evident are the opportunities present in today’s markets available to long-term investors. Markets today are not completely efficient--bank balance sheets are not unlimited and idiosyncratic supply and demand dynamics can make some markets expensive and others cheap. Implementing a dynamic overlay can greatly improve the efficiency of achieving a program’s SAA. When combined with a strong investment risk management framework overseeing all the important details (introducing no leverage relative to the SAA and robust daily collateral management), an overlay program can solve a variety of portfolio management needs in a very cost-effective manner.

Some plan sponsors believe overlays are not allowed via their IPS to avoid leveraging exposure; however, upon a better understanding of their use as a risk management tool, they realize they indeed are allowed. Overlay programs may help solve many of plan sponsors’ biggest portfolio management challenges in a cost-effective solution: they reduce performance issues associated with cash drag, tracking error and rebalancing costs, and increase cash liquidity.

Overlay 1.0 – Equitizing cash

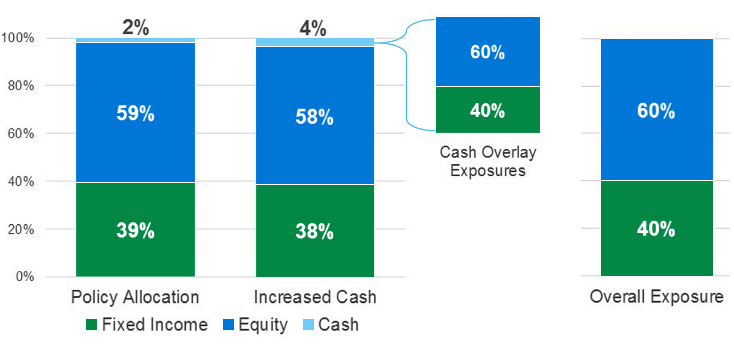

Equitizing cash is often the first step plans take towards a holistic overlay program. An important challenge that plan sponsors face is how to maintain, or increase, the liquidity of their plan to pay benefit payments or to use as dry-powder for tactical allocations while avoiding deviation from their fully-invested policy benchmark and cash drag. Cash equitization is a simple, straightforward solution. By sourcing cash pro-rata across investments (or from a continually underperforming allocation), plan sponsors can create a larger cash pool on top of which an overlay provider can build synthetic exposures that mirror their policy benchmark. Figure 1 illustrates how an equitization program allows for larger pools of liquidity while avoiding the full cash drag and increased tracking error to the policy benchmark.

Figure 1: Cash Equitization

Source: LGIM America.

Overlay 2.0 – Rebalancing synthetically

A natural progression from cash equitization is an overlay program designed to periodically rebalance the plan back to its policy benchmark. The extreme volatility, increased transaction costs, and liquidity crises that investors experienced in 2020 have re-ignited the need for a systematized approach to cost effectively rebalance to minimize tracking error.

Like other market-based benchmarks, policy benchmarks generally snap back at the beginning of the month in their predetermined allocations (e.g. 60/40 equity/fixed income) and assume frictionless rebalancing. If the actual assets are not rebalanced, the plan will incur tracking error against its policy benchmark. Allocators must weigh the potential for ex-ante policy benchmark tracking error against the physical transaction costs to rebalance.

If volatility and transaction costs are high, plans may want to rebalance but not want to pay high rebalancing costs. This occurred in Q1 2020 when plans needed to rebalance when it was extremely costly. However, if volatility is high and the plan can rebalance cheaply, a rebalance may look more attractive to minimize tracking error. The use of derivatives can significantly reduce the rebalance cost. For instance, an overlay manager could utilize Treasury or equity futures and/or total return swaps to rebalance.

Take a pension plan with a synthetic rebalancing program in place during the initial phase of the COVID-19 crisis. Assuming this plan was 60% S&P 500, 40% Long Gov/Credit on February 1st, before COVID-19 fears struck the market, by the end of March it would have been 6% underweight equities and 6% overweight fixed income without any rebalancing.

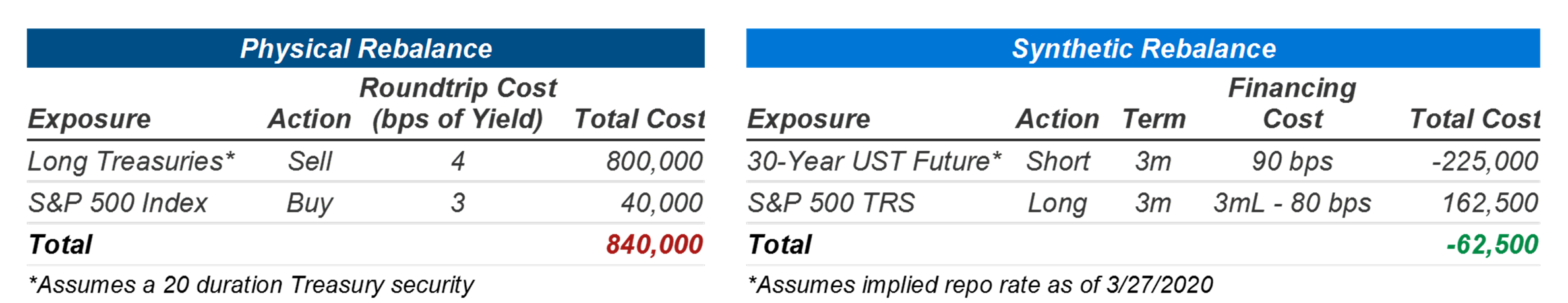

This plan faced a question all too familiar to its peers in 2020--whether the costs to rebalance were worth the savings in tracking error. Was it possible to rebalance cheaper than in the physical market? Figure 2 illustrates the approximate costs to execute this rebalance in late March 2020 for a $1.7B plan (rebalancing $100mm) physically vs. synthetically. The plan would have netted approximately positive $60,000 through synthetic rebalancing activities due to prevailing market dynamics. This is especially striking compared to the estimated physical transaction cost of $840,000.

Figure 2: Rebalance Comparison

Source: LGIM America and Bloomberg.

To be sure, rebalancing costs are not typically profit producers. To take advantage of these opportunities when available, LGIMA can take certain discretion in a client’s rebalancing program and replace physical exposure synthetically when the trade would net a profit; e.g. the costs for entering a total return swap are determined to be lower than the combined costs of selling existing physical securities and replacing the sold securities synthetically.

A rebalancing program is generally most beneficial in volatile markets. When equities underperform, exposure will be increased; when fixed income outperforms, exposure will be decreased. As markets reverse, plans may have added exposure at troughs and decreased exposure at peaks, potentially providing the plan an added layer of protection. This type of rebalancing will underperform non-rebalanced plans in trending markets but may provide protection in volatile markets when plans need it most. In both types of markets, the objective is to decrease overall tracking error. These benefits are true of a rebalancing program in general; rebalancing synthetically may provide substantial transaction cost savings.

Conclusion

Once a cash equitization or synthetic rebalancing program is underway, the piping is in place to solve a variety of additional portfolio management needs. Plans can nimbly implement tactical allocations synthetically or quickly add downside protection. What are often considered separate programs provide the added benefit of flexibility and efficiency at the plan level.

With a better understanding of the value an overlay can add, overlays become a tool to solve the most pressing portfolio management problems: liquidity, cash drag, transaction costs, and tracking error. Importantly, these programs generally introduce no net leverage for a plan in that total exposures will never be greater than the assets a plan owns. In a cash equitization program, exposures will equal the amount of cash. In a rebalancing program, any long derivative positions will be met with short derivative positions elsewhere. As with any investment, risks do exist--e.g. market risk, counterparty risk and credit risk--underscoring the importance of partnering with an experienced manager. 2020 was a year of unpleasant surprises--while we can provide no promises about 2021, an effective overlay program may, at the very least, remove rebalancing from the list of your potential headaches.

Multi-asset overlay capabilities at LGIMA

LGIMA’s Multi-Asset team focuses on asset allocation and the cross-asset interactions to manage risk and cost. We collaborate with clients as strategic partners in a customized fashion to deliver comprehensive risk management solutions using a variety of tools. We work to understand specific client desired outcomes, needs, and constraints to balance portfolio construction and operational / legal requirements by using a multi-instrument approach where possible and working through ISDA and FCM documentation in partnership with the client. For further information about these strategies, please reach out to us at www.lgima.com/contact-us.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of November 2020 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.