Navigating Fixed Income's Versatility

While there was essentially nowhere to hide in fixed income in 2022 due to inflated valuations, today’s entry points may provide investors with potential opportunities to build diversified, opportunistic and durable portfolios. But unpredictable markets and elevated economic uncertainty calls for an active and flexible approach to security selection and portfolio construction.

Fixed income may be a good place to be

After a decade of accommodative policies and ultra-low interest rates, the fixed income landscape has changed. The rock-bottom interest rates of the last cycle helped to lift assets, leading investors into riskier parts of fixed income or other return-seeking assets. Post-pandemic, we note structural shifts such as decarbonization, deglobalization and geopolitical instability can create more triggers for growth volatility and episodes of bearish sentiment. We believe a restored allocation to fixed income can help to balance portfolios through these episodes given higher yields have significantly strengthened the protective power and income benefits of high-quality bonds.

Shorter duration allocations have been a common strategic portfolio shift

Shorter duration strategies, such as Intermediate credit, look attractive in the current environment. There exists more opportunity at the front-end of the credit curve given very low issuance at the back-end – CFOs would rather lock-in 5 years of high interest borrowing vs. 30 years – creating a more dynamic trading landscape. Further, shorter duration strategies can be a strong fit within a liability driven investing (LDI) framework; as rates have moved higher over the last 15 months, liability durations have fallen across the board (average profiles of 12-14 years have declined to 10-12 years). Moreover, the deeply inverted yield curve in the US has served to bolster the appeal of shorter-duration strategies. These allocations can offer more opportunities to generate alpha, a better match to plans’ liabilities and higher outright yields.

As volatility increases, so does the value of flexibility

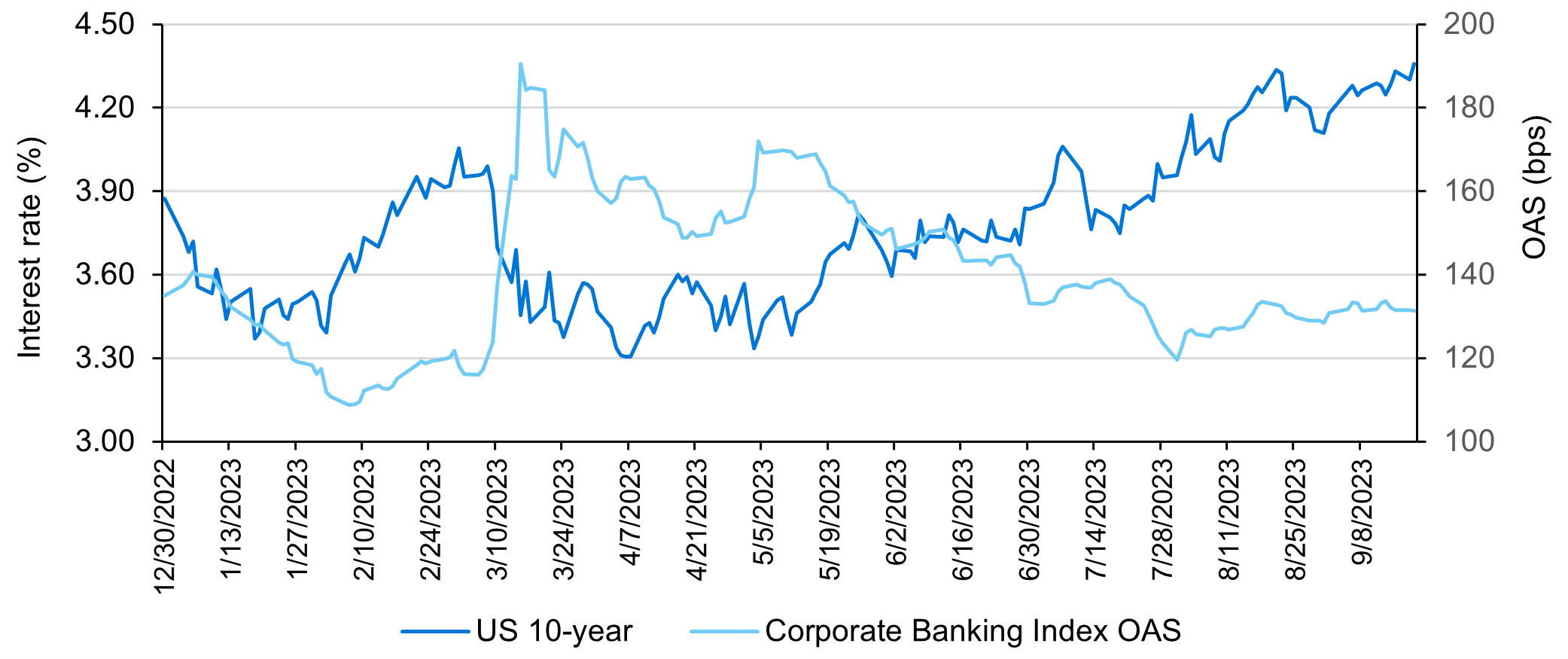

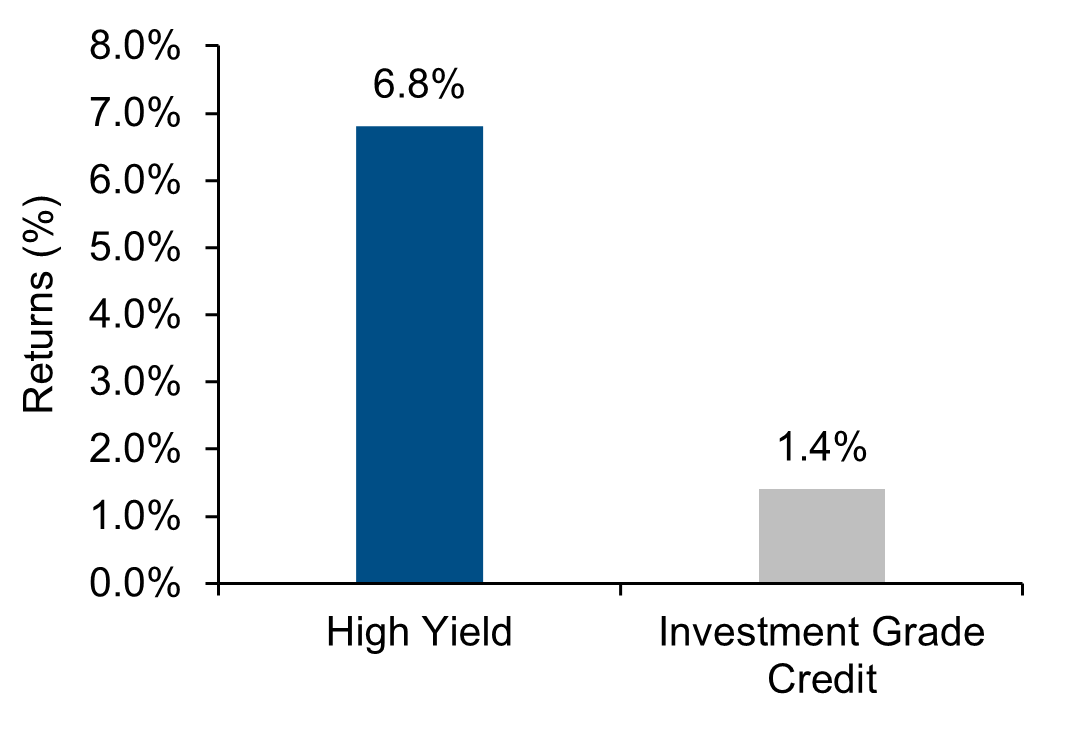

Within the fixed income universe, investors can pull a variety of levers: sector exposure, duration, asset classes, etc. In 2023 alone, we’ve seen whipsawing volatility in the banking sector, interest rates falling 57 basis points only to then rise roughly 100 basis points,1 and high yield credit meaningfully outperforming investment grade year-to-date (6.8% to 1.4%).2 There is value in choice, specifically in the choice to take certain risks while avoiding others.

Figure 1: 10-year rate and banking spreads (year-to-date)

Source: Bloomberg, Data as of September 20, 2023.

Figure 2: Fixed income returns (year-to-date)

Source: Bloomberg, Data as of September 20, 2023.

One of the most compelling benefits of securitized assets is their low correlation to other fixed income sectors. This is primarily because of the floating rate nature of most securitized assets, which significantly reduces interest rate sensitivity. Further, the securitized sector can also offer attractive income relative to other fixed income assets with a similar credit rating. For example, Bloomberg’s Non-agency CMBS index, rated AAA/AA1, currently carries an option-adjusted spread (OAS) of 225 basis points over Treasuries while the US Credit Index, rated A2/A3, offers 109 basis points of OAS.3

Markedly higher short-term yields particularly support enhanced cash solutions/absolute return strategies. These often allow investors to avoid taking on too much duration risk while maintaining the ability to dynamically change asset class exposures. For example, fixed income investors can benefit from exploiting opportunities across investment grade and high yield credit, emerging markets and securitized sectors with the goal of generating positive total returns while minimizing interest rate sensitivity.

For those investors interested in taking on duration and expanding the toolkit to include Treasuries and longer duration products, more traditional multi-sector strategies can serve as an attractive option for total return focused and LDI driven investors alike. These are typically higher alpha strategies designed to outperform in challenging markets. Today’s elevated volatility, above-target inflation and shifting asset correlations create a compelling environment for managers to generate excess returns.

We’re here to help

At LGIM America, we’re always available to discuss the macro environment and its implications for growth, monetary policy and fixed income strategy holistically. We remain focused on achieving client objectives by building both opportunistic and resilient fixed income portfolios for our clients.

1. Bloomberg; 10-year US Treasury from 12/31/2022 to 4/6/3023 to 9/20/2023.

2. Bloomberg US Credit Index and Bloomberg Corporate High Yield Bond Index as of 9/19/2023.

3. Bloomberg as of 9/20/2023.

Disclosures

Derivatives are for sophisticated investors who are able to bear the risk of capital loss.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.