Private Credit – The Calm Before the Storm

The private credit market has generally been resilient this year. The investment-grade and crossover space has seen decent deal flow, pricing discipline, strong premiums and not forgetting a higher yield environment. Tighter credit conditions and bank retrenchment is likely to accelerate the shift towards private market financing, in our view.

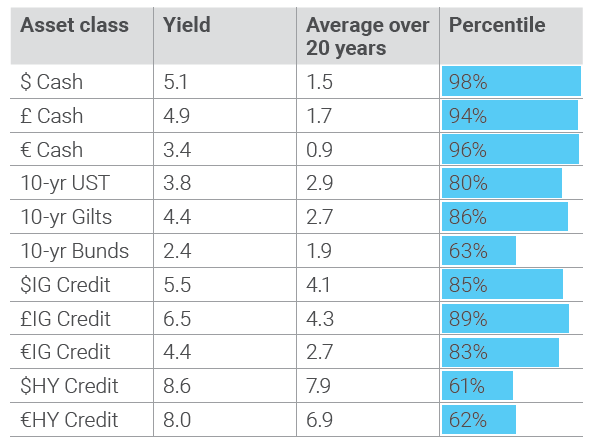

Yields remain high

Driven by higher rates, yields remained elevated, with US cash and US 10-year Treasury yields in the 95th and 70th percentiles, respectively, compared with their 20-year averages. Investment-grade private credit is currently yielding at c.5-7% and crossover (BB rated) at c.8-9%, also much higher than the historical average.1

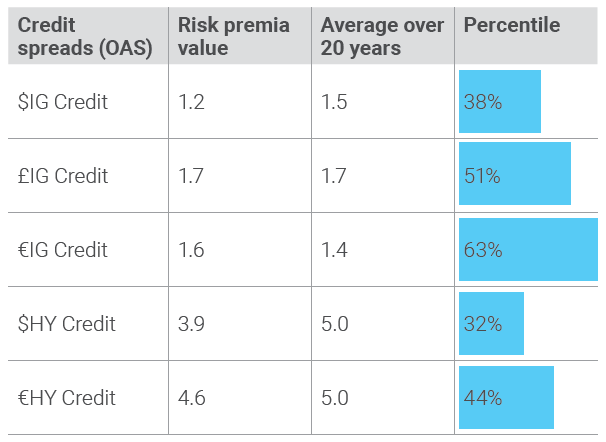

Sterling and dollar investment-grade public credit spreads are hovering around their long-term averages, while euro credit spreads are cheaper relative to their long-term averages, which may represent a potential buying opportunity. High yield spreads, in comparison, look less attractive when you consider the heightened recession risk. Understandably, most borrowers are not keen to lock in current rates for a long period and prefer to issue shorter-term debt.

Figure 1: Asset class yield averages

Figure 2: Credit spreads (OAS) risk premia

Source: Bloomberg, LGIM analysis as of June 30, 2023.

Busy market, helped by bank retrenchment

Market volatility in 2022 drove borrowers to the more stable private credit market. This accelerated again in 2023 as the banking crisis and tightening credit conditions caused borrowers to reduce reliance on banks and the public market. Within the corporate debt space, we saw a broad sector mix of European corporate issuers. In the US, corporate issuance was dominated by energy infrastructure and utilities which are more cost agnostic (they can pass through the debt cost increase to the consumers under the regulatory regime).

Not everyone is tapping into the market. Some borrowers such as housing associations are reliant on low-cost, long-term debt and have been very quiet this year. REITs, which make up a big chunk of the US corporate debt market, have also been quiet following weakening sentiment regarding commercial real estate.

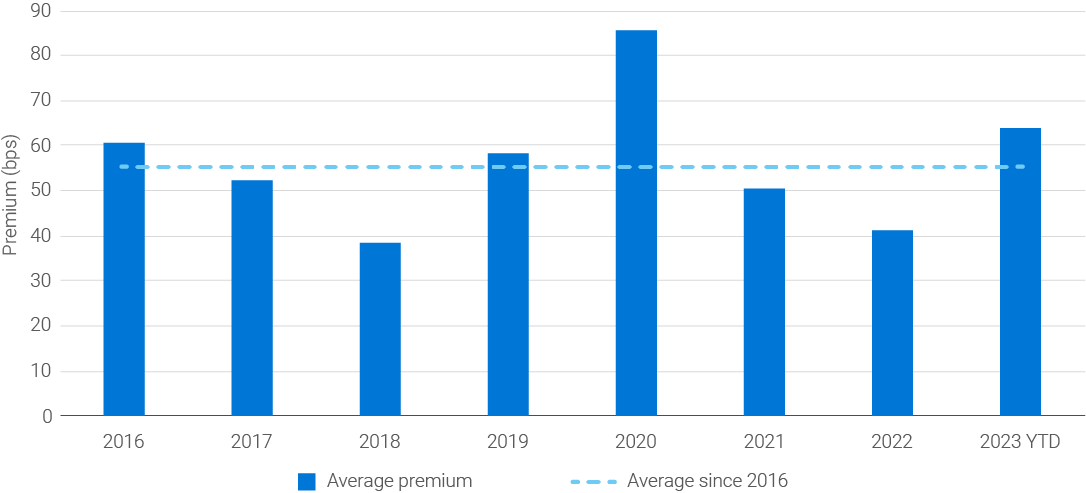

Greater divergence, more investor-friendly dynamics

Investors are increasingly cautious and selective. Appetite for high-quality assets is still strong but overall investors have been less aggressive on price. Premium versus public bond comparables have generally been higher than average this year. This growing divergence between defensive issuers and weaker, more cyclical issuers, has resulted in the latter needing to offer better terms to attract interest. This is somewhat different from the public bond market, where spread dispersion across sectors is low within investment grade (with the exception of financials vs non-financials).

Figure 3: Investment-grade private credit premium versus comparable public bonds has been higher than average in 2023

Source: LGIM Real Assets. Data as of June 30, 2023.

1. Source: Bloomberg as of June 2023.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.