Remembering Rho – How Higher Interest Rates Can Make Equity Hedging More Appealing

With the Federal Open Market Committee (FOMC) recently hiking interest rates for the eleventh time in twelve meetings, it may seem a bit banal to point out that the era of ultra-low interest rates is over. However, while we have been living with higher interest rates for some time now, certain market relationships that were dormant during the past 15 years of (near) zero interest rate policy are only beginning to be revisited. Interestingly, this high rate environment may present an opportunity to use options strategies to protect return seeking assets. In fact, S&P 500 protection strategies, like the put spread collar, are near their most attractive levels in over a decade, thanks in large part to the Fed’s new rate regime.

High interest rates present opportunities for pension plans

As we’ll demonstrate within this blog, there is an opposing relationship between the price sensitivities of put and call options with respect to interest rates. When rates are low and sticky, this relationship becomes relatively inconsequential for most investors. However, when interest rates are elevated, much like today’s environment, pension plans are in a distinct position to take advantage of the impact on options prices.

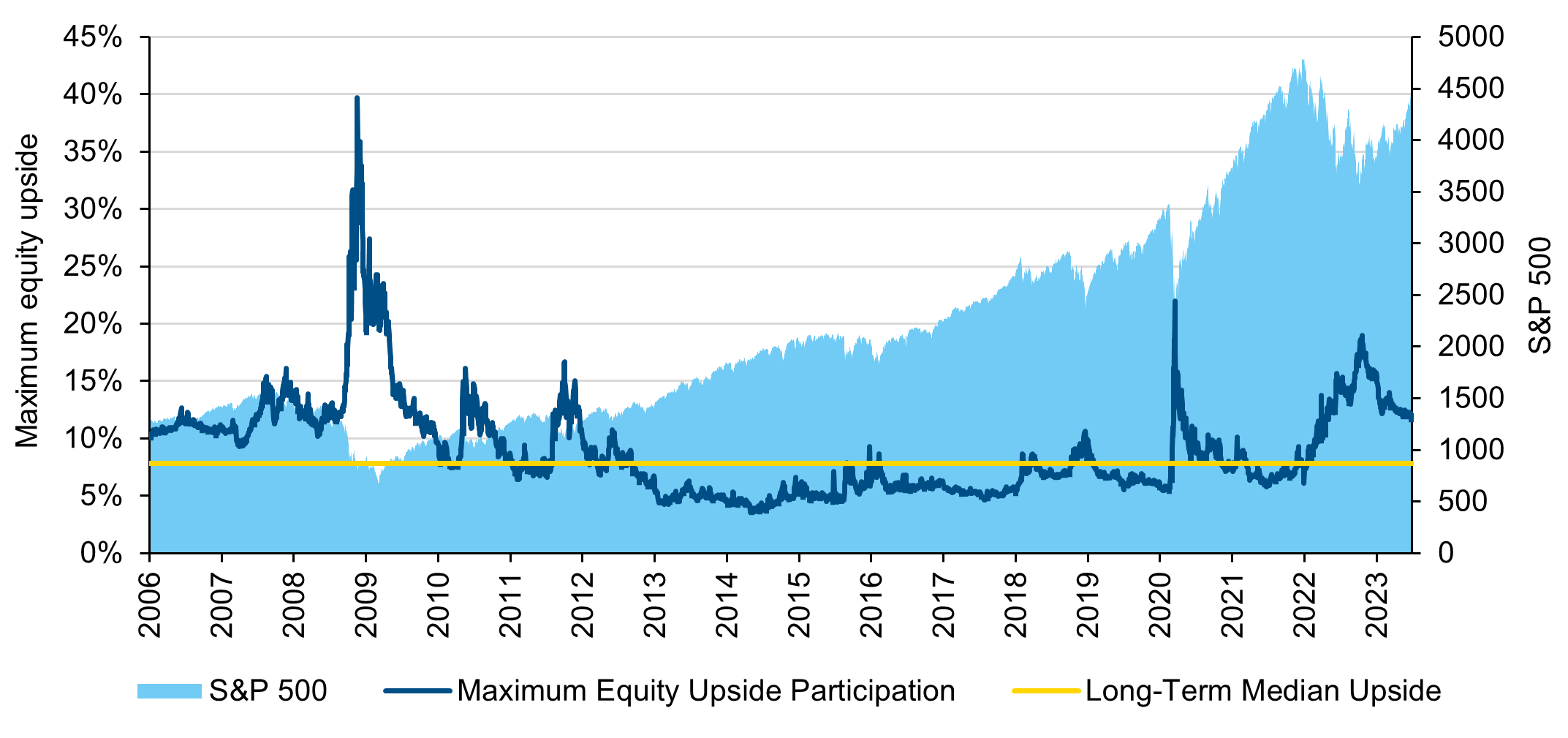

Commonly, plans seek to reduce the upfront cost of hedging by selling an option (or series of options) to offset the premium to buy a protective put. In the face of rising interest rates, plans can achieve this objective while extracting increased value by selling richening calls to buy cheapening puts. A put spread collar – a traditional component of the pension hedging toolkit – capitalizes on this dynamic because it becomes cheaper as interest rates rise, all else equal. For plans seeking a zero-premium structure, this cheapening translates to an elevated sold call strike, therefore allowing plans the opportunity to participate in greater equity upside. The chart below shows the evolution of this costless structure through time. Note that plans hedging today have the opportunity to capture 4% more upside than the median observation over the past 16+ years.

Figure 1: Maximum equity upside participation on costless 1-Yr 80% / 95% S&P 500 put spread collar

Understanding the relationship between options and interest rates

Figure 2: Option sensitivity to interest rates (rho)

| Interest Rates Increase | Interest Rates Decrease | |

|---|---|---|

| Calls | More expensive | Less expensive |

| Puts | Less expensive | More expensive |

Source: LGIM America. For illustrative purposes only.

Though this relationship may not be intuitive at first, it can be demonstrated by considering the concept of put-call parity. This formula states that the difference between the price of a call and a put (of the same strike price and time to expiration) must equal the spot price less the present value of the options’ strike price and the present value of dividends to be paid before the options expire.

Call – Put = Spot price – PV (Strike price) – PV (Dividends)

As a simplified example, consider a world with zero interest rates and no dividends. In this case, the present value of the at-the-money (ATM) strike price is simply equal to the spot price, and after dropping the dividend term, the right-hand side of the equation is equal to zero. Therefore, to satisfy the formula, there must be no difference between the value of the at-the-money call and the at-the-money put; in other words, the price of the call and the put must be the same.

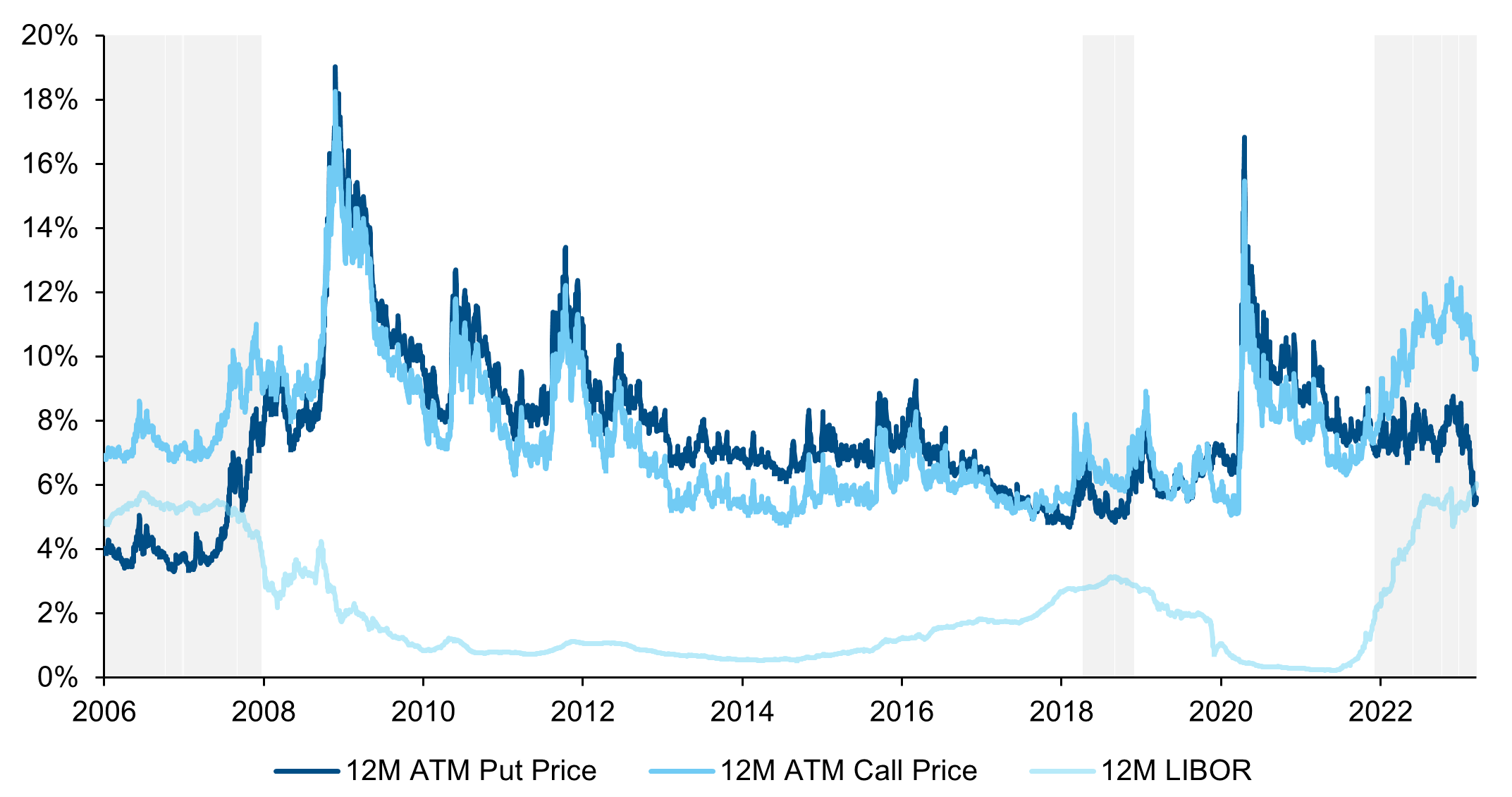

Now, imagine that interest rates have instantaneously risen, thus causing the present value of the at-the-money strike price to decrease relative to the spot price. This results in some positive value for the right side of the equation (again, assuming dividends are zero), and necessarily, the left side must be positive as well. This means that because of interest rates rising, the price of the call must increase relative to the price of the put, confirming the directionalities established earlier. This relationship can be observed historically by plotting the prices of the 12-month S&P 500 at-the-money put and call versus interest rates.

Figure 3: 12-month at-the-money S&P 500 options prices and interest rates

Source: Bloomberg. Data from January 3, 2006 – June 30, 2023.

Between 2008 and late 2018, and again between 2019 and late 2021, the spread between the prices of the ATM put and call is minimal, commensurate with decreasing and/or near-zero interest rates (note: minor differences due to dividend expectations). However, during times of peaking interest rates, such as the highlighted periods, calls become significantly more expensive relative to puts. As a recent example, on June 30, 2023, the 12-month S&P 500 at-the-money call cost approximately 9.9% of total notional, compared to just 5.6% for the ATM put, nearly a 78% premium.

Conclusion

The end of the era of ultra-low interest rates has simultaneously ushered in new risks. With expanded valuations fueled by the recent equity rally, ongoing geopolitical tensions, and continued debate over the Fed’s pathway to a soft-landing, it may prove advantageous for plans to consider hedging strategies to help narrow the distribution of plan outcomes in the face of mounting uncertainty. We believe put spread collars are a useful risk management tool in this market environment. We also remind plans to remember rho, too, because today’s elevated interest rates can make this classic equity protection strategy even more appealing.

Disclosures

Derivatives are for sophisticated investors who are able to bear the risk of capital loss.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.