Securities Lending: Is the game worth the candle?

Securities lending is, on the surface, a fairly straightforward process. The owner of a security earns a fee by lending it to another party in exchange for collateral, and when the collateral is cash, subsequently reinvesting it. The key is evaluating whether this reward is worth the risk. How much can be earned by lending the security to another party and reinvesting any cash collateral? How much risk is being taken through the collateral and counterparty exposure? These answers can depend on evolving market conditions.

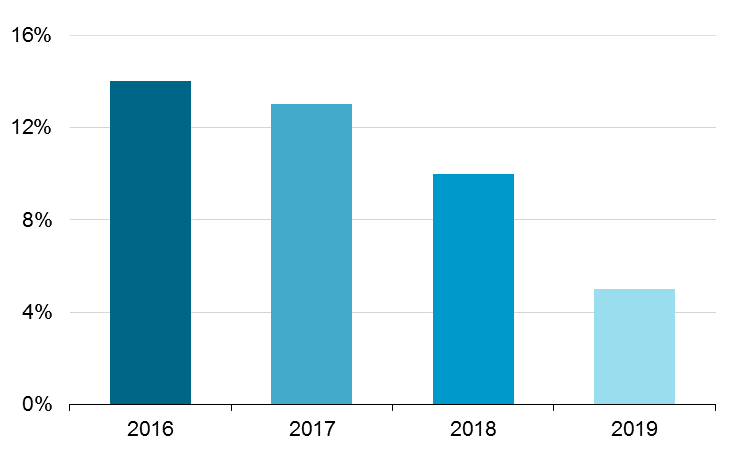

One interesting observation of the current environment is that securities lending returns have fallen significantly from a few years ago. From the first quarter of 2016 to the second quarter of 2019, the average percentage of US equities on loan yielding between 21 and 50 basis points fell by approximately two thirds. The same trend is observed in the market for securities that trade “special,” defined as yielding greater than 50 basis points in the securities lending market, as depicted in Figure 1. Given this, it bears asking whether the practice is worth it in today’s market.

Figure 1: Average US equity specials on loan (>50 basis points)

Source: DataLend. As of July 2019.

Over the last decade, the number of participants in the securities lending market has ballooned. As funds have moved from active to passive, the number of natural lenders of stocks and bonds, notably index funds and ETFs, has proliferated. Many public plans have also initiated large lending programs, further adding to the supply. The value of securities on loan globally hit a multi-year high of $2.6 trillion in the first half of 20181. The surge in supply has put downward pressure on yields, which has been exacerbated by dynamics on the demand side as well. Factors further contributing to low yields have been the low volatility environment, relatively slow pace of mergers and acquisitions, and market uncertainty around trade risks that has led to less shorting activity by hedge funds.

These dynamics warrant questioning whether managers are taking on more risk in order to generate incremental basis points of return, beyond the intrinsic value of the securities. Some index fund providers that utilize affiliated business arms to run their lending programs (and which are simultaneously being squeezed on fund expenses) may feel pressured to chase yields by dialing up the credit or counterparty risk. Questions that investors can ask their index fund managers to better understand the exposures in their securities lending programs include:

- What percentage of the securities lending revenues is paid to the fund versus the lending agent?

- What revenues are generated by reinvesting the cash collateral—and who captures them?

- Are there any expenses or costs from the securities lending process that are applied to the funds and not borne by the lending agent?

- What is the counterparty approval process and how often is it revisited? What is the legal entity providing the indemnity and what is their credit rating?

- What indemnification do you provide for losses incurred from securities lending and collateral reinvestment?

Most importantly, investors should remember that securities lending is not a free lunch and always consider the risk and reward of these programs. In today’s environment, the question that arises is that given the rock-bottom yields on offer, is the securities lending game still worth the candle?

1. Source: Financial Stability Oversight Council, 2018 Annual report.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of September 2019 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.