SFA Program Update - What a Difference Two Years Can Make

The Special Financial Assistance (SFA) Program was included within The American Rescue Plan Act of 2021 with the sole purpose of assisting financially troubled multi-employer defined benefit pension plans. The objective is to enhance the retirement security for millions of Americans by providing adequate funds in the amounts required for the plan to pay all benefits due through the end of the plan year 2051. According to the Pension Benefit Guaranty Corporation (PBGC), approximately $97 billion in SFA funding is expected to be disbursed to over 250 multi-employer plans that cover more than 3 million participants and beneficiaries.1 At the time of this publication, approximately $53.5 billion in special financial assistance has been paid out to recipients.2

In our update on the SFA program, we aim to leave readers with three main takeaways:

- Treasury portfolios by themselves may target or even exceed long-term hurdle rates.

- Investment grade credit portfolios can improve risk-adjusted results.

- SFA allocations should be made within a total portfolio context.

Treasury portfolios by themselves may target or even exceed long-term hurdle rates

As we enter Year 3 of the program, the market environment is vastly different to when the rules were first announced. In mid-2021, the PBGC issued an interim final rule stating that all funds were required to be invested in high-quality fixed income. At the time, high-quality fixed income was yielding something in the range of 1-2%.

Industry participants were quick to provide feedback that recipients needed a wider investment toolkit in order to achieve their hurdle rate on SFA assets (often in the 3.5-4.5% range). If not, the rules would almost guarantee that the assistance would fall short in its stated purpose. As a result, the PBGC issued a final rule that allowed up to 33% of SFA capital to be invested in equities. However, fixed income currently yields significantly more than 2-years ago when the program was first announced. This has led many stakeholders to rethink the optimal solution for SFA assets.

Figure 1: Portfolio construction types and associated yields

| 10/31/2021 | 10/31/2023 | Change | |

|---|---|---|---|

| 100% Treasury – Yield (%) | 1.31% | 4.99% | 3.68% |

| 100% IG Credit – Yield (%) | 1.99% | 6.11% | 4.12% |

Source: LGIM America and Bloomberg as of October 31, 2021, and October 31, 2023.

Figure 1 examines two portfolio construction types (100% Treasuries and 100% Credit) at two time periods (October 2021 and October 2023). Given the dramatic rise in yields over the past 2 years, SFA portfolios with a high proportion of Treasuries likely can meet or exceed the plan sponsor’s hurdle rate.

Investment grade credit portfolios can improve risk-adjusted results

Although Treasuries may be enough to meet the plan sponsor’s investment objectives, we believe the addition of credit in SFA portfolios can improve risk-adjusted results. Let’s assume a plan has received $1 billion of assistance and has the sole objective of meeting the next 10 years of their benefit payments. This may allow their legacy asset portfolio to grow and, combined with future contributions, could give the plan a high likelihood of solvency beyond 2051. Our analysis focuses on the probability of a portfolio meeting the objective of 10 years of benefit payments. Determining the optimal solution will need to be viewed within the context of the plan sponsor’s unique situation and risk appetite.

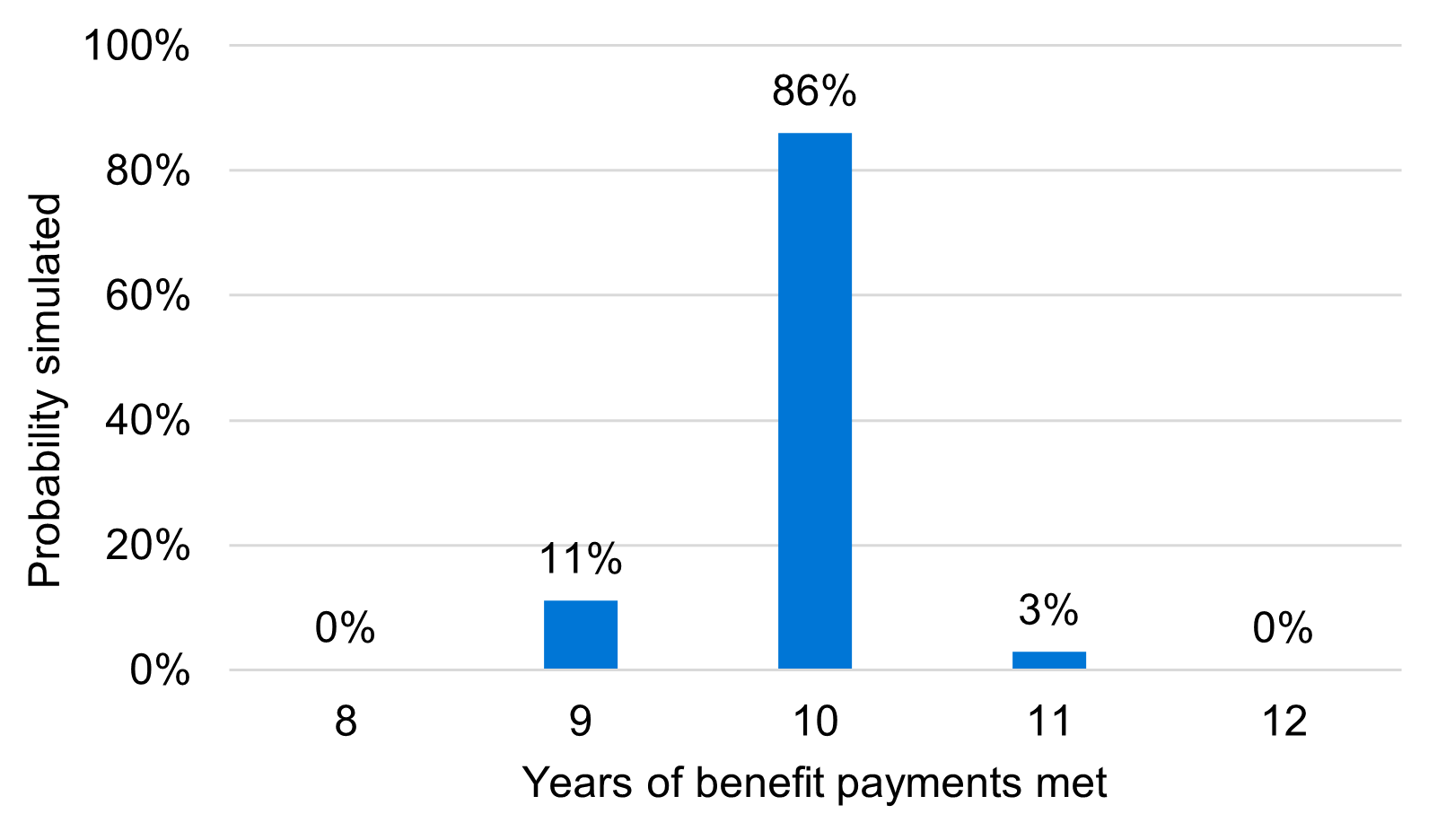

Figure 2: Portfolio 1 – 100% Treasuries

Source: LGIM America. For illustrative purposes only.

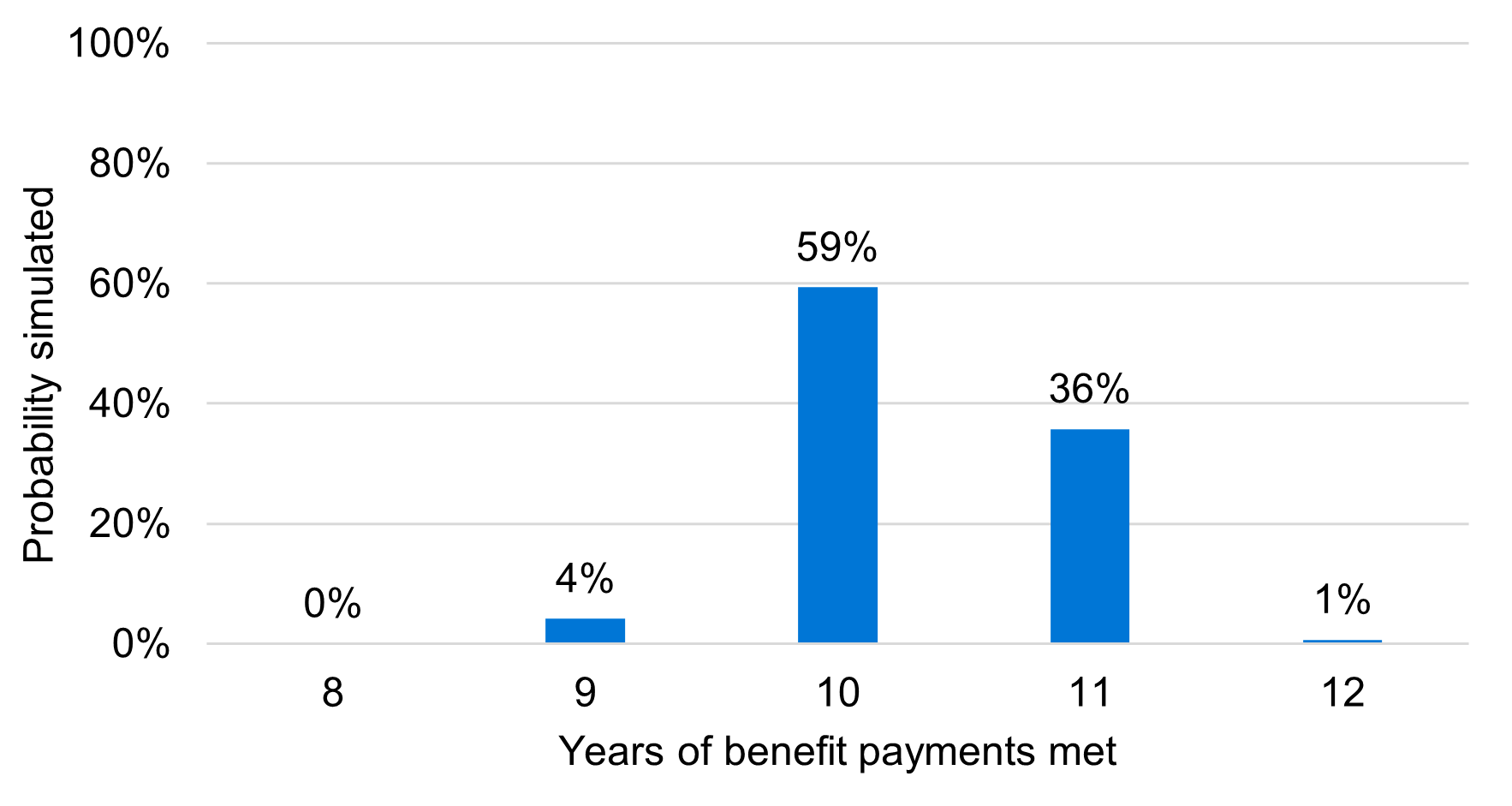

Figure 3: Portfolio 2 – 100% Credit

Source: LGIM America. For illustrative purposes only.

As illustrated in Figure 2, the 100% Treasury portfolio has a high likelihood of meeting the plan’s next 10 years of benefit payments. In many conversations to date with industry stakeholders, plan sponsors are increasingly taking a conservative approach. This example is emblematic of the decisions facing many plan sponsors receiving this assistance. Initially, many believed a wider investment toolkit was required to meet their investment objectives, whereas fixed income now offers sufficient yield with much lower risk.

As seen in Figure 3, the credit-only portfolio lowers the risk of falling short of the 10-year goalpost, while giving the sponsor a much higher likelihood of surpassing 10 years. When including credit within the SFA portfolio, one must consider the introduction of default risk. Given the relatively short-term nature of the SFA program, defaults will drastically increase the probability of falling short of the sponsor’s cashflow-matching objective. It is imperative to employ a manager that has a successful track record avoiding landmines and preserving value, especially if the sponsor has a more conservative risk tolerance.

SFA allocations should be made within a total portfolio context

Lastly, we believe the SFA allocation should be made within a total portfolio context. There is no one-size-fits-all solution for plan sponsors receiving SFA capital. There are a range of factors that may influence the appropriate solution, including, but not limited to, amount of SFA capital received, size of legacy asset portfolio, composition of legacy assets, expectations of future contributions and plan sponsor risk tolerance. The decision to include equities must be weighed within the context of the plan. Including equities within the SFA portfolio may increase the range of outcomes and give the sponsor much less certainty on how many years of benefit payments the assistance can cover. For sponsors that have a more balanced risk appetite and may not expect future contributions, there is a stronger argument to include equities. Of course, we believe these decisions and allocations should be viewed more holistically across the SFA and legacy asset portfolio.

In summary, the SFA program is a once-in-a-generation type of opportunity. The assistance may help many multi-employer plans avoid insolvency and extend retirement benefits for millions. Given this backdrop, many sponsors view this capital through a more conservative lens. Others take a more holistic approach and view their legacy portfolio in tandem with their SFA portfolio. Each sponsor will need to weigh these decisions within the context of their plan. At LGIM America, we have the experience and desire to partner with those who own the decisions around the SFA capital.

1. Source: PBGC as of July 19, 2023. American Rescue Plan Act FAQs | Pension Benefit Guaranty Corporation (pbgc.gov)

2. Source: PBGC as of November 9, 2023.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.