Closed for Renovations – The Retirement Supermarket

The defined contribution (DC) system places greater investment liability on plan participants, emphasizes asset accumulation and falls short when providing the tools, structure and education necessary for sustaining income in retirement. Unlike the defined benefit (DB) system that provided retirement income in the form of pension payments throughout retirement, retirement income in DC remains a work in progress.

Defined contribution hits a four-decade mark

As the DC system is relatively new compared to the DB system, people are only now starting to retire after spending their careers planning for retirement through this method. In contrast to 1975, when active participants in DB plans outnumbered DC participants by nearly 3-to-1, by 2019, participants in DC plans out-numbered DB plans by 86 million versus 13 million, respectively.1 This trend is also reflected in the total plan assets. At the end of 2022, the DC market was valued at $19.9 trillion, compared to the $10.2 trillion in DB plans.2 Although the DC market has done a commendable job gathering and growing participant assets pre-retirement, the ability to spend down these assets throughout retirement remains an open question.

Turning the focus from accumulation to spending

There are approximately 73 million baby boomers, and the majority are not covered by a defined benefit plan.3 As they retire, they are anticipated to walk away with a lump sum. As a result, it is expected that they will have questions they want answered by their advisors or employers, such as how long the lump sum can last and what level of spending is sustainable.

The industry must address the ‘retirement income’ questions and seek to provide answers about how retirees can sustainably live off lump sum defined contribution balances in retirement. Though much of the advisory and DC space focused on accumulation of assets, the focus for many near retirees is shifting to decumulation, or systematic spending, of assets to fund retirement.

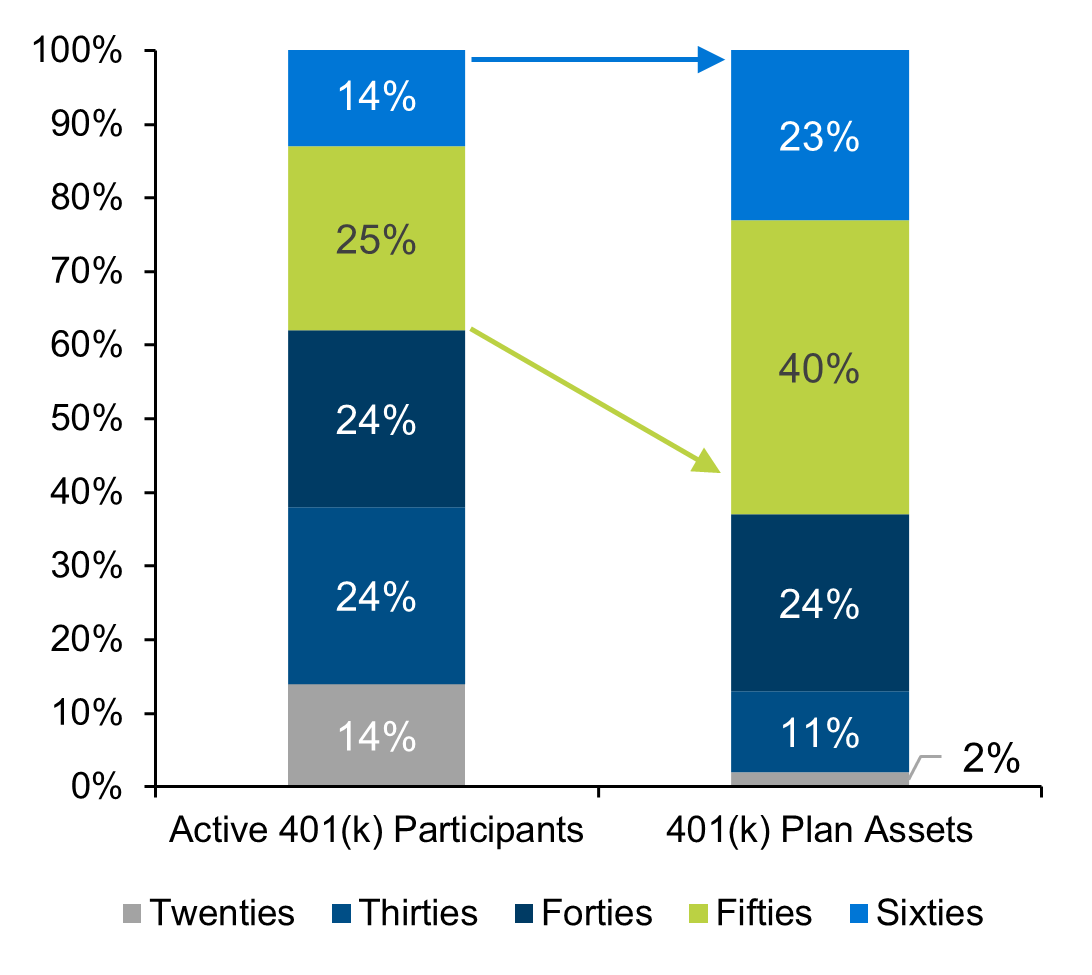

Given the sheer number of participants retiring daily, primarily without defined benefit plans, the question of post-retirement income takes on fresh urgency. For advisors working with DC plans, or in the wealth space, it is this very cohort where the bulk of assets reside. Baby boomers (defined as those born between 1946 and 1964) hold a disproportionate amount of wealth relative to previous generations. Having had the luxury of longer time to build assets, baby boomers hold 52% of the nation’s household wealth, while comprising 21% of the population.4 A similar dynamic holds even when we look at just 401(k) accounts as a proxy of retirement assets in Figure 1.

Figure 1: Share of participants and assets by age

Source: EBRI Issue Brief No. 576 November 2022, 401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2020.

Over time, this age cohort will spend down and transfer their accumulated wealth. As such, individuals need strategies for managing these assets, both in terms of drawing down assets to fund retirement and potentially setting aside assets for bequest purposes. Strategies that are adopted must be varied and appeal to the diverse needs of different types of retirees.

The need for diverse strategies

Retirees have diverse needs and circumstances, so different strategies will be attractive to different groups of retirees. An individual’s level of engagement is another aspect that differentiates potential solutions. Additionally, the level of savings often dictates the level of advice and handholding provided. Wealth advisors often happily serve those at the top of income distribution. For those at the very bottom, Social Security frequently provides the bulk of retirement income. However, there is a significant need for solutions for retirees in the middle income range. Therefore, it is crucial for plan sponsors and advisors to thoroughly understand the characteristics and needs of the end users in order to better achieve success.

Another aspect of strategies to consider is whether they are designed to be employed in-plan or out-of-plan. It is during the retirement period when we see an inflection point for thinking about retirement income solutions. Certain solutions are designed to operate in-plan while others, by design, exist out of plan (e.g., an IRA account). In practice, assets typically stay within DC plans for several years after the individual retires. The shift though occurs once the participant hits the required minimum distribution age (generally 72 or 70 ½ if you reach 70 ½ before January 1, 2020). So, although those in their 60s hold 23% of 401(k) assets, this figure drops to 3% for those in their 70s.5

At this point, and to a lesser degree at retirement, the battle for the rollover is waged. The participant must decide whether to keep their assets in the plan or roll it to an Individual Retirement Account (IRA). Rollovers from defined contribution plans provide a key plank for the growth of the IRA market. Rollovers between 2016 and 2021 accounted for $2.9 trillion in IRA asset growth.6 About 60% of IRA-owning households indicated in mid-2020 that their IRAs held rollover assets from 401(k) and other DC plans. And the bulk of those, some 81%, had rolled over their entire retirement account balance into an IRA. The IRA is often a direct sale from the recordkeeper or affiliated with a pre-existing advisor relationship.

DC plan sponsors are increasingly interested in retaining retiree assets to maintain scale and reduce costs. The number of plan sponsors seeking to retain retiree assets in-plan has grown from 28% in 2016 to 76% in 2022.7 This emerging battleground for retiree asset placement reinforces the necessity for advisors and solutions to remain flexible as the retirement world (as represented by DC plans) and wealth (as represented by the IRA market) increasingly converge. For those working with DC plans and the wealth market, it is crucial for a solution to be flexible enough to be implemented in both ecosystems in order to ensure successful utilization.

We want to help

At LGIM America, we understand plan sponsor’s concerns around different types of risk. We welcome the opportunity to provide additional insight into our retirement thinking and capabilities. For more information, please contact us at Inquiry.DefinedContribution@lgima.com.

1.Source: Congressional Research Service “A Visual Depiction of the Shift from Defined Benefit (DB) to Defined Contribution (DC) Pension Plans in the Private Sector” December 27, 2021 https://crsreports.congress.gov/product/pdf/IF/IF12007

2.Source: Investment Company Institute Quarterly Retirement Market Data, December 15, 2022 https://www.ici.org/research/stats/retirement

3. Source: United States Census Bureau

4. Source: Federal Reserve Bank Distribution of Household Wealth in the United States, data for Q3 2022.

5. Source: Employee Benefit Research Institute 401(k) Database

6. Source: Correia, Margarida. “DC rollovers fuel IRA growth to $13.9 trillion, largest part of market” Pensions & Investments. January 23, 2023.

7. Source: Callan DC Trends Survey.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.