What To Do in Volatile Markets

The novel coronavirus, in conjunction with escalating tension in relation to oil production, created waves of volatility throughout capital markets. As market dynamics and client needs evolve, we seek to be a partner to our clients in maintaining the alignment of their objectives and constraints with available opportunities. Among the various risks that investors are contemplating today, this piece focuses on the risk of further equity drawdowns and the risk of paying too much for rebalancing back to policy benchmarks. The following addresses those risks and provides strategies to measurably shape investment outcomes in short-order.

Disciplined risk management approach

Asset allocation decisions are the primary drivers of risk and return. In volatile environments, it can be tempting to second guess the strategic asset allocations clients have adopted: What if equities fall further? Should we change our benchmark? Should we still adhere to these glide path trigger points? The cost of overreacting can sometimes exceed the cost of not doing anything. It is important to remember the long-term objectives of the plan and implement a framework that can be used both in volatile and less volatile environments. In practice, we work with our clients to understand and model different risk factors present in their portfolio, and communicate our ongoing risk assessment.

We believe a disciplined risk management approach ensures the current investment strategies remain aligned with the most appropriate risk/reward relative to a portfolio’s objectives.

1. Reduce impact of drawdowns by buying insurance

How important is this?

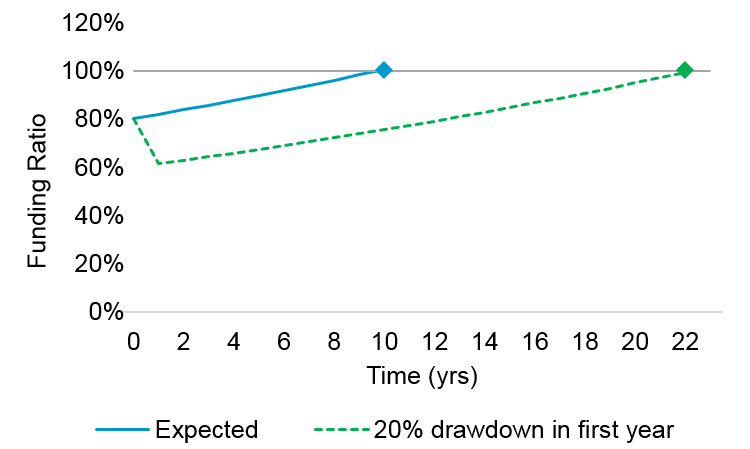

Significant drawdowns can impact the time it would take for plans to get to full funding and cause meaningful disruption for plan sponsors.

Source: LGIMA. Chart depicted above is intended for illustrative purposes only.

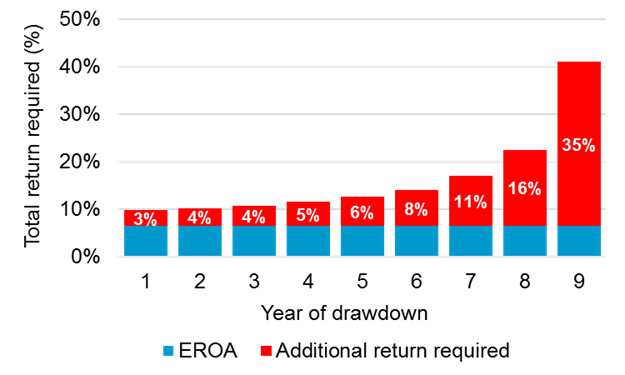

When plans’ investments do not achieve their expected return, their long-term goals are at risk. The below shows the additional return needed for a sample plan to reach full funding over a 10-year period, assuming a 20% drawdown occurs in a given year.

Source: LGIMA. Chart depicted above is intended for illustrative purposes only.

How might a plan generate the necessary additional return to meet long-term goals? Will the plan need to re-risk the portfolio? These are questions that can significantly disrupt companies’ financial projections and potentially the safety of the benefits owed to plan participants. For these reasons, and good risk management considerations, it makes sense to evaluate ways to help protect equity portfolios.

Insurance considerations

Buying equity protection is similar to buying insurance to protect a house or car from an adverse event. In the case of equity protection, this insurance can be obtained in two ways: Paying for the protection upfront or selling the right to future equity returns above a certain threshold.

Is now a good time for equity protection?

The answer depends on how that protection is funded. For example, if we are buying the protection outright, we would want this “insurance” to be cheap and/or have a strong view that equities will continue to fall.

However, as we’ve seen in markets these past two weeks, uncertainty abounds. So, what if protection is not cheap and we’re uncertain?

We can sell potential upside to fund the protection. However, if we are selling away potential return gains to buy downside protection, we need the value of what we are selling to be relatively high.

Downside protection - Client example

As the news of the coronavirus was breaking, some of our clients looked to buy equity protection by selling upside potential.

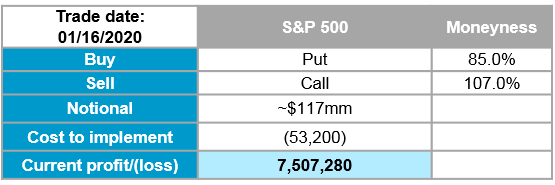

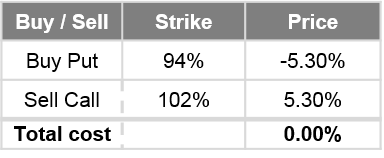

The example below highlights one such action. On January 16th, the client bought a put option funded by the sale of a call option to help protect 50% of their equity portfolio against potential market drawdowns. The structure of the option collar was struck to be near zero premium; other structures are also executable depending on client preference.

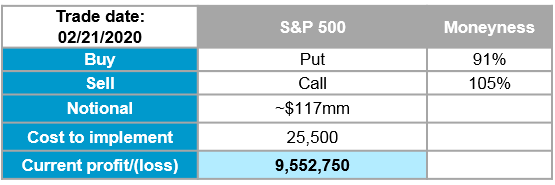

Moneyness is the strike price of the option as a percentage of the underlying index price level. In the table above, it means the protection starts if the market falls 9% to 91% of its current value, in exchange for giving up any return above 7% of where the market value is. As volatility was increasing, the client decided to execute another structure on February 21st to help protect the remaining 50% of their equity portfolio against further drawdowns.

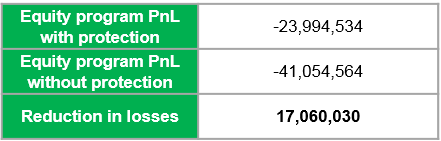

Given the fall in equities over that time period (January 16th – March 11th of -17.4%), the option collars have resulted in a substantial profit since inception. Without the protection in place, the plan would have lost ~41mm. With the protection in place, the plan only lost ~$24mm. This is a great example of implementing protection strategies in an approximately costless manner to mitigate the market stress on the equity portfolio.

Source: Bloomberg. Tables depicted above are intended for illustrative purposes only. As of 3/11/2020.

Downside protection - Current market opportunity

Investors can achieve costless protection in a variety of different ways. As seen below, current market conditions are still advantageous. The below illustrates two of many possibilities.

Here, investors can obtain protection past a 6% fall while only sacrificing gains past 2%.

Source: LGIMA. As of 12:30pm CT 3/12/2020: Please note that prices are changing rapidly in this market environment and past performance is not an indication of future returns.

Alternatively, investors can obtain protection from current levels and down an additional 22% (at which point protection is offset by a sold put) while only sacrificing gains past 2%.

Source: LGIMA. As of 12:30pm CT 3/12/2020: Please note that prices are changing rapidly in this market environment and past performance is not an indication of future returns.

It is important to remember that, like any form of insurance, it can only go so far. In a market as volatile as it is now, the appropriate form of risk mitigation can go a long way in helping investors fulfill their fiduciary duties.

2. Utilize synthetic rebalancing to save on transaction costs

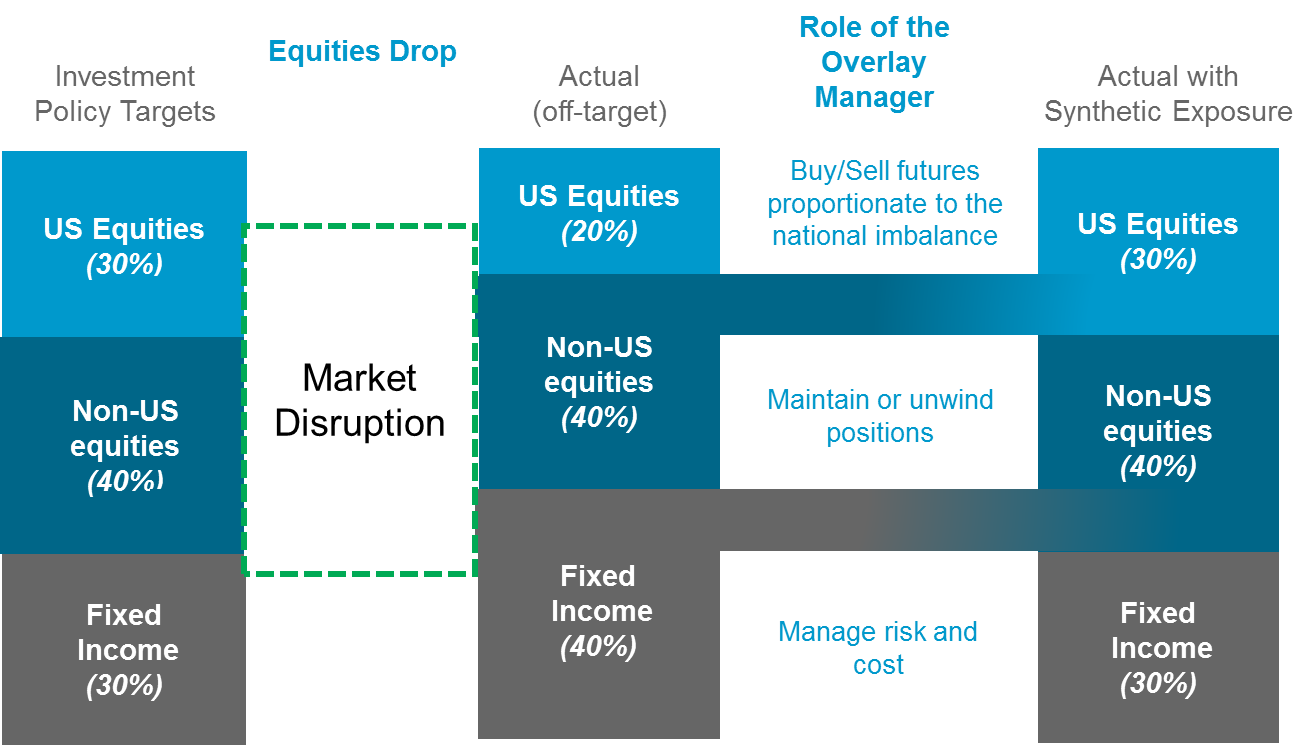

Rebalancing is an important risk management strategy for investors. Rebalancing can be thought of as any allocation decision to bring the portfolio asset weights back towards what investors consider their ideal asset allocation given long-term views. Due to the recent market movements, many portfolios have imbalances which need to be adjusted to reflect the strategic asset weights.

The ideal rebalancing strategy

An optimal rebalancing strategy balances the benefits of staying close to a set risk profile against the costs of doing so. These costs can take the form of transaction costs, or opportunity costs due to the impact on expected return.

Saving on transaction costs in volatile markets

The rapid fall in equity markets and its magnitude will force investors to sell fixed income and buy equities to rebalance their portfolios. When trading physical stocks and bonds, transaction costs can become burdensome as dealers need to be compensated for providing liquidity. This is amplified in volatile and illiquid markets making rebalances potentially very expensive. For example, some fixed income products this week have traded at over 5x their usual transaction cost.

Especially in times like these, investors should consider using a derivative overlay to implement rebalancing operations. This has the potential to bring portfolio-level risk back to the policy target with enhanced liquidity, lower cost, faster execution and settlement, and increased capital and collateral availability. The simple figure below illustrates the rebalancing dynamics using an overlay:

Chart depicted above is intended for illustrative purposes only.

Implementation expertise

While a derivative overlay can offer multiple efficiencies to an investor, it must be implemented with high levels of precision. For example, equity rebalancing is typically extremely low cost, and equity misweights are commonly responsible for the largest contribution to a plan’s potential tracking error. So, it is common for us to rebalance our overlay clients’ equity exposures on an as-needed basis – and up to a daily frequency, if necessary.

On the other hand, certain fixed income exposures may have available derivatives with low-to-no basis risk and high cost or high basis risk and very low cost. We approach each action on a case-by-case basis, conscious that any transaction could be more expensive in this environment. Continually assessing the different cost and risk trade-offs is critical to selecting the most appropriate rebalancing decision.

We view these exercises as risk management strategies, and partner with our clients on the most efficient instruments to use based, in line with what is allowed in their investment guidelines.

Rebalancing considerations for corporate DB plans

Custom liability-driven investing (LDI) clients, who utilize leverage in their hedging strategy, can experience a dramatic shift in the implied funding costs between instruments such as Treasury futures and equity futures during periods of volatility.

- As equity markets decline, it typically becomes much cheaper to obtain equity exposure synthetically

- As bond markets rally, it typically becomes much more expensive to obtain rates exposure synthetically

Therefore, for custom LDI clients with flexibility, there can be opportunities to reduce the overall costs associated with the investment and liability hedging programs if they are able to be nimble between cash and derivative instruments across asset classes. We can facilitate this with separate accounts that can utilize either our equity index funds or cash and equity derivatives in order to move assets to fund exposures that would be more expensive to target synthetically.

Disclosures

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of March 2020 and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.